Vegan food is big business. That’s probably not news to you if you’ve been to a café in Melbourne recently. $18 for a falafel burger? Pull the other one.

While most Aussies aren’t quite ready to totally give up animal protein just yet, the demand for plant-based and ethical alternatives to our favourite meats is burgeoning and undeniable, Food Frontier communicates.

Regardless of what you think about vegans or their diet, you can’t ignore that businesses catering to them are a growth area. Even fast food chains like Grill’d, McDonalds and Hungry Jacks have started adding vegan options to their menus in order to court the meatless dollar.

DMARGE spoke to James Whelan, Investment Manager at VFS Group in Sydney, who related how even investors skeptical of veganism are increasingly interested in plant-based meats.

“I’m the son of a cattle farmer and even I think Beyond Burgers are tasty,” he laughs.

Now, recent developments in the agriculture sector thanks to The Bat Kiss have got investors especially interested in the ever-growing alternative protein market.

Whelan relates how a recent abattoir shutdown in Germany thanks to COVID-19 reveals how exposed the meat industry is to pandemics and other shakeups in the global economy.

“This virus spreads like wildfire through slaughterhouses… Germany’s R Number almost tripled over the course of a weekend from 1.06 to 2.88 from basically one region’s abattoir. 6500 workers in a Rheda-Wiedenbrück abattoir and 1300 of them tested positive. That’s a big number and it’s apparently due to the working conditions the migrant workers are put through.”

Germany’s not the only country with this problem. China recently halted imports from Tyson Foods, one of the US’ biggest meatpackers, who’s faced fierce criticism for exacerbating the spread of the pandemic whilst simultaneously lobbying government to restart production and obfuscating infection rates. China itself has been grappling with a recent outbreak of the virus traced to salmon sold in the country’s largest wet market, Whelan reports.

Famously revealed in Eric Schlosser’s groundbreaking 1999 exposé Fast Food Nation (and earlier still in Upton Sinclair’s The Jungle in 1906), the conditions in abattoirs and meatpacking concerns are often horrendous and notoriously unsafe. It comes as no surprise that they are natural vectors for viral transmission.

At Tyson plants around the country, over 7,000 employees have tested positive for the virus. Workers continue to die from Covid-19.

On Sunday, China suspended poultry imports from a Tyson slaughterhouse due to coronavirus cases among its workers. https://t.co/VjAldls2tm pic.twitter.com/CUkW3aXcB1

— New York Times Opinion (@nytopinion) June 22, 2020

Animal slaughterers shutting down or having their exports banned will naturally affect the global meat supply and drive prices up for consumers, as well as cause economic instability.

“Expect meat prices to go up as companies bear the burden for improved working conditions and most likely put a hand out to the government to assist in this situation (since it’s virus-related),” Whelan predicts.

But that’s not the main takeaway from this meat industry health scare, he says.

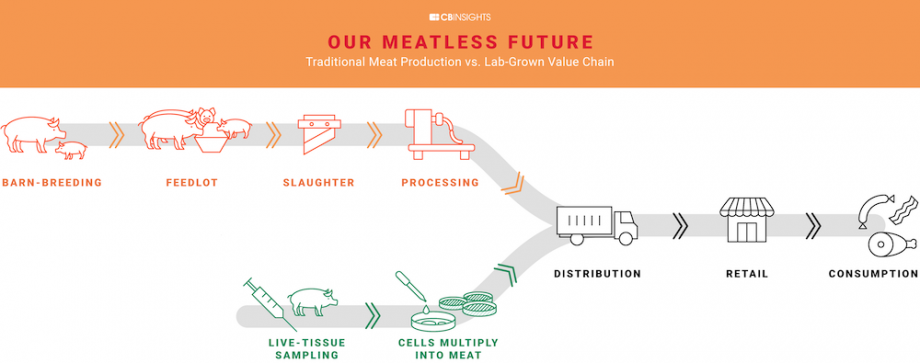

These businesses shutting down not only affect the supply of meat, but have a huge knock-on affect for an entire supply chain. Logistics, retailers, and other businesses who use the byproducts of meat production will all be affected by the meat industry’s vulnerability to coronavirus.

“So… food is getting scarcer because virus or because politics or because both. Either way, buy a deep freeze and fill it up. Or buy a plant-based meat company.”

James Whelan

Look at it like this: animal meat is already becoming less and less popular, and is particularly vulnerable to this virus that demonstrably can devastate entire industries (and countries). Food security is a big deal – even if you don’t care about the ethical implications of animal meat, it’s hard to argue with the ‘COVID argument’, Whelan expounds.

Investing in businesses in the plant-based meat space right now makes sense because the way it’s made inherently contains far less chance of spreading the virus, is far less vulnerable to supply chain disruption, is ethically superior for both animals and humans, and is only likely to continue growing.

While lab-grown meats are yet to hit the market in a meaningful way, vegan food producers are your safest bet. Besides, it’s not just vegan meat replacements we’re talking about here: vegan milk alternatives and vegan leather will spike in demand if cows aren’t being killed, for example.

With no clear end in sight to this global pandemic, and an increasing consumer interest in worker’s rights, animal welfare and sustainable protein sources, investing in vegan and alternative protein businesses seems like a no-brainer.

You might not see us carnivores chowing down on a tofu burger any time soon, but our portfolios might tell a different story.