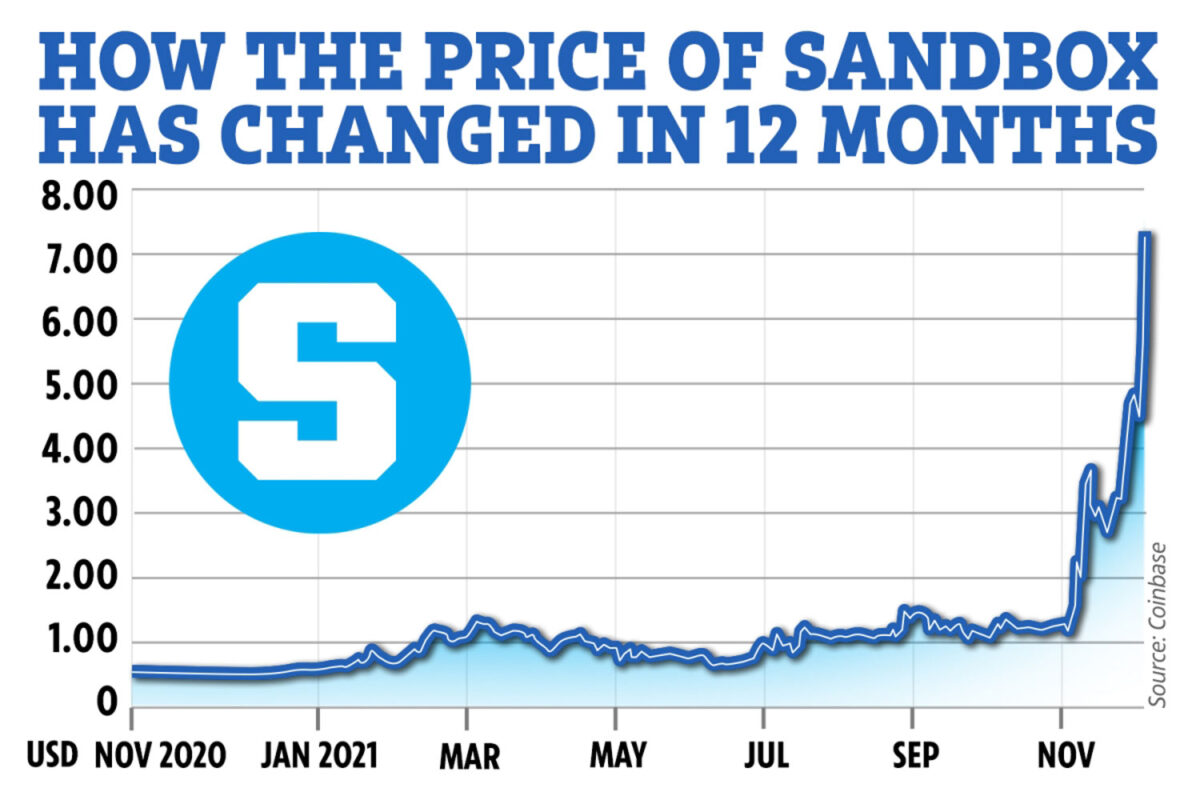

The Sandbox’s native token (CRYPTO: SAND) has rallied over 600% since Facebook’s rebrand as Meta and 25% since Adidas appeared to confirm a partnership with it (in a tweet). But what is it? The Sandbox is an ethereum based blockchain project which lets users play in a virtual world (kind of like Mindcraft), creating and exploring galaxies.

It used to be a mobile and PC game, but was acquired by Animoca Brands in August 2018 (and was brought into the blockchain).

Players complete tasks, such as making a certain material using other assets. They can also save their progress and put it on a public gallery (which is arguably where there is great potential for the world of NFTs to come in further).

There are various other similar projects and games though, so what makes The Sandbox so special? After all, it’s not the only metaverse game with its own token. It’s also not the only game that allows users to create and use NFTs or integrate them with a marketplace.

This whole industry is booming, with new competitors cropping up all the time. So we’ll ask a second time: what makes The Sandbox the golden child right now?

The reason The Sandbox is sucking up the lion’s share of investment right now is due to a few things (though any interested investors ought to be warned, as with any crypto, this could change at any point in the future).

The first reason is traction creates traction. Success breeds success and – currently – The Sandbox has a sh*t load of it. According to The Motley Fool, “As of early November, it [The Sandbox] had more than 500,000 registered wallets and 12,000 virtual land owners on its platform.”

“It was also able to raise $93 million in a Series B financing and has had some high-profile names such as Snoop Dogg engage with the platform,” The Motley Fool recently reported. This has aroused many people’s interest and has them wondering: is it too late to invest in The Sandbox’s native token SAND?

Is it too late to invest?

— gen4us.eth (@gen4us1) November 23, 2021

Indeed, as other coins have seen pullbacks (see: Dogecoin, Shiba Inu, and even Bitcoin) lately, SAND has been holding up many people’s crypto portfolios, as it has continued to boom.

@TheSandboxGame pic.twitter.com/ora0UaPj9A

— nemesis (@nemesisogch) November 22, 2021

For this reason, as well as because of how quickly it has jumped up the ranks, many people believe The Sandbox is – though inherently risky, being a small crypto (compared to big hitters like Bitcoin and Ethereum) – a potentially lucrative investment that could have a lot more legs in it.

Coindesk reports: “The token [SAND] has also benefited from the highly anticipated play-to-earn metaverse event, The Sandbox Alpha, scheduled for three weeks from Nov. 29 to Dec. 30.”

Get ready for The Sandbox Alpha!

— The Sandbox (@TheSandboxGame) November 16, 2021

📅 Launching November 29th

🌍 Anyone can experience the Alpha hub and three experiences

🔷 5,000 Alpha passes giving access to content, NFT, and 1,000 SAND!

Get all details below 👇https://t.co/63iAl5MMmS pic.twitter.com/OiXmbAWYN2

The Motley Fool reports: “Given the outsize interest around the metaverse space, and the implications that blockchain-based metaverse games could have in this environment, this is a cryptocurrency that investors appear to be ready to jump on. Of course, like all cryptocurrencies, there’s inherent risk with owning any digital asset that’s difficult to intrinsically value. However, given the various catalysts driving this cryptocurrency higher, it appears there may be quite a long way for this one to run.”

inews.co.uk recently wrote about the impact comments made by Facebook CEO Mark Zuckerberg have had on The Sandbox, attributing part of its price soaring to him.

Zuckerberg told Facebook’s annual conference: “Over time, I hope that we are seen as a metaverse company and I want to anchor our work and our identity on what we’re building towards.”

inews.co.uk wrote: “One of the world’s most powerful companies putting so much stock into the concept of the metaverse piqued interest in platforms like The Sandbox and Decentraland.”

As for The Sandbox’s price prediction, it would be silly for anyone to make any certain claims.

That said, CoinGape wrote on Tuesday, under the subheading, “Sandbox Price Analysis: Can The Uptrend Be Sustained?” that “SAND is currently trading on a second bullish session and has formed an ascending channel on the daily chart.”

CoinGape also noted: “As long as Sandbox price remains within the confines of the rising channel, its uptrend will be sustained. A closure above the upper boundary of the chart pattern at $5.54 will see SAND rise to discover new prices above the $5.63 ATH.”

CoinGape added: “However, the price action has resulted in the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicators reaching extremely overbought level suggesting that the bullish could fizzle out pointing to a possible correction in the near-term.”

“Therefore, if SAND fails to discover support at $4.98, it way drop to seek support from the middle boundary of the rising channel at $4.54. A drop below the middle boundary could trigger massive sell orders that are likely to pull Sandbox towards the lower boundary of the channel at $3.52 or the moving averages below it,” (CoinGape).

SAND is available on Binance, Upbit, Huobi, Uniswap, Kukoin, LCX, Bittrex, Lbank, Gemini, Indodax, crypto.com, Latoken, Bitmart, Liquid, MXC, Poloniex, Simplex, Tokyocrypto, Wazirx, Nbf, Bithumb, and MAX.

At the time of writing SAND is trading at A$10.09, according to Coinbase, and has increased 96.51% in the last 7 days.

You should never invest more than you can afford to lose in any cryptocurrency, especially small, speculative ones like SAND.

Although well-known coins like Bitcoin and Ethereum have been gaining more mainstream acceptance lately, with just a month ago ASIC giving the green light for the trading of Bitcoin and Ethereum ETFs (as well as the ASX’s first crypto focussed ETF – CRYP – launching), the world of individual cryptos like SAND is still a bit of a wild west.

RELATED: The Safest Way To Invest In Crypto, For Those That Don’t Like Risk

Investing in individual cryptos like SAND is inherently a far riskier business than investing in a legitimate crypto ETF or more well-known coin like Bitcoin (and even these have a reputation for being volatile compared to your bread and butter non-thematic ETFs on the ASX or S&P 500, which simply track the traditional market index). If you want to play with fire though, SAND could be a portfolio altering game-changer (for better or worse).

Read Next