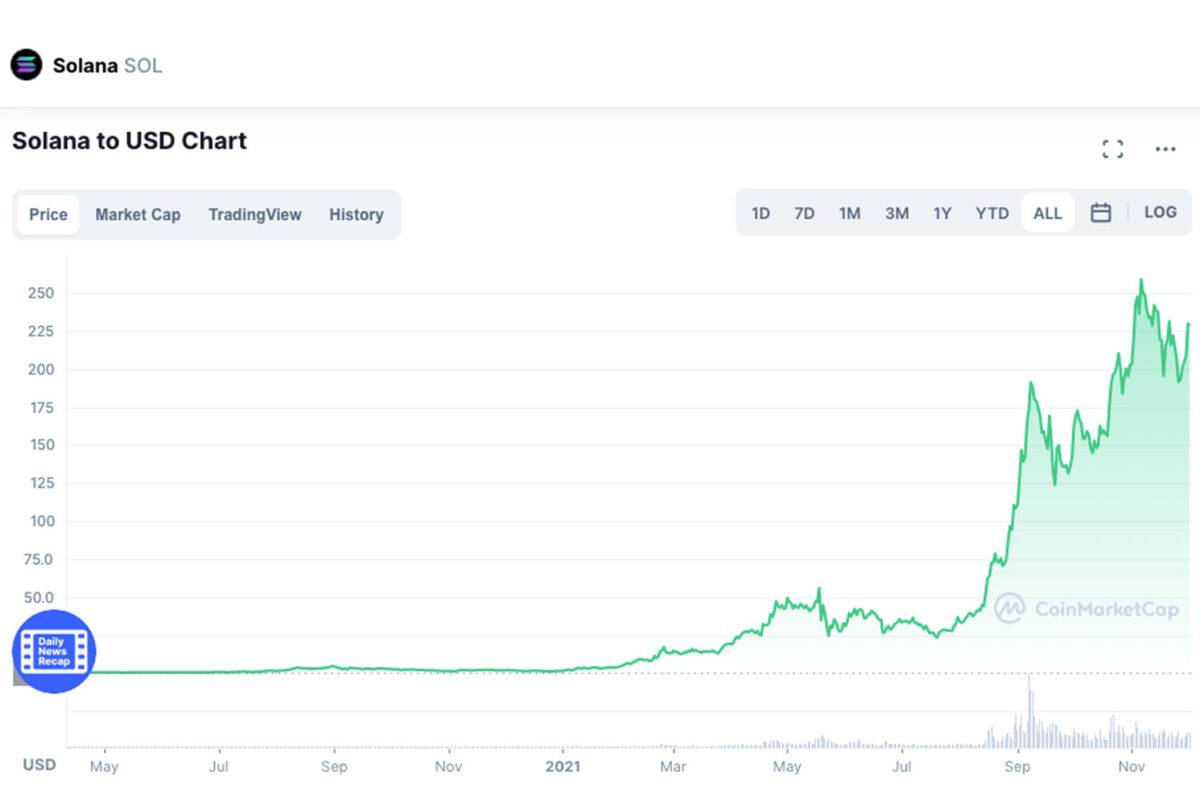

Using ‘exponential growth’ to describe Solana’s (SOL) climb in 2021 would be an understatement. The predicted rival to Ethereum reached all-time highs of $363 AUD earlier this month, after entering the year at under $2. Far from being a mere pump and dump, Solana has cemented a position among the top 10 cryptocurrencies, touting the 5th biggest cryptocurrency market cap behind Bitcoin, Ethereum, Binance Coin and Tether. It’s even being touted as the ‘Ethereum destroyer’.

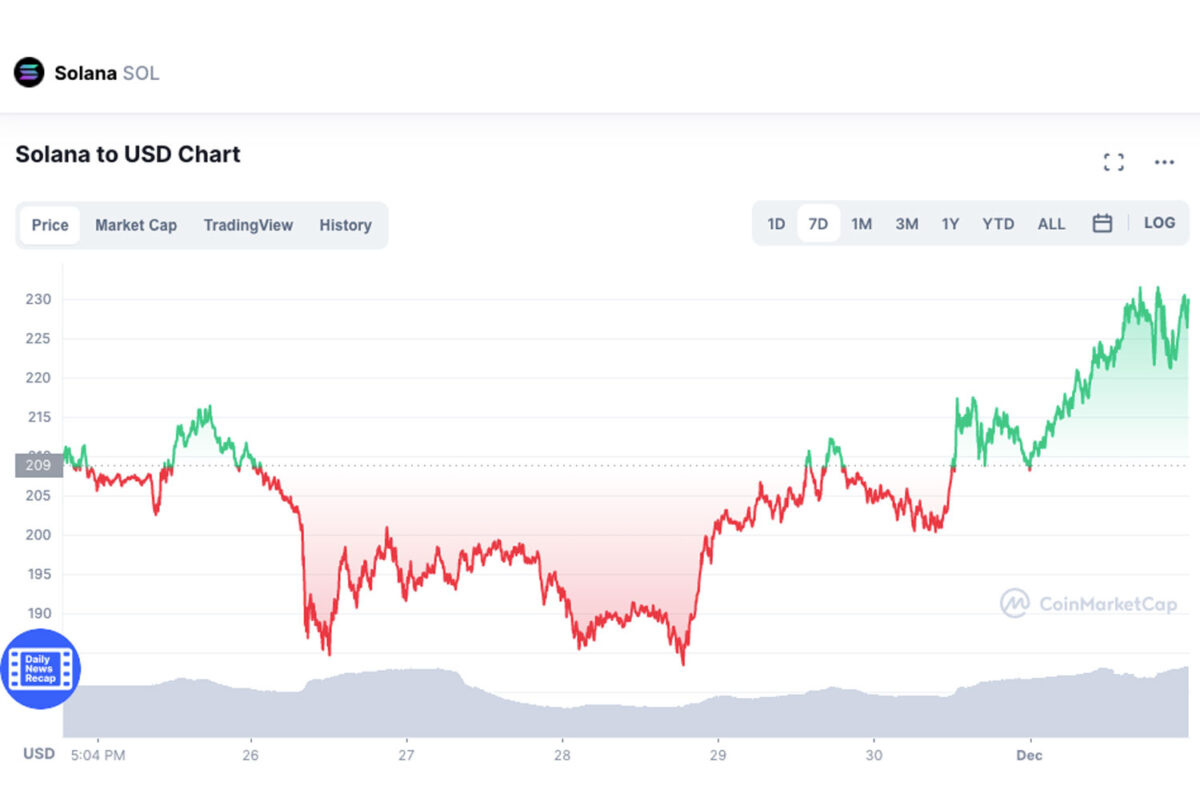

Despite declining a little since its all-time high of $363 AUD at the start of November, this week Solana has been increasing in price again. Seven days ago from the time of writing Solana was $292 AUD. Now it’s $322 AUD.

So, what has fuelled Solana’s rise? And why did Reddit co-founder Alexis Ohanian recently invest $100 million in its ecosystem?

Solana has been described by many to be a future key player of Web 3.0 – the idea that the internet will soon enter a new era that will see it become underpinned by decentralised applications reliant on smart contracts. These smart contracts, facilitated by a blockchain attached to a cryptocurrency, possess the unique ability to automatically and dependably verify the validity of transactions between parties, thus enabling the creation of a seamless and secure global digital market.

Although Ethereum has been perceived to be the leading facilitator of these smart contracts (and it’s still by far the biggest name in crypto after Bitcoin), growing concerns around its long transaction wait times, hefty fees that increase with demand, and its questionable ability to scale have caused Solana’s unique capabilities to stand out.

Solana’s proof of stake blockchain is extremely fast and low cost to use, touting a transaction time of 0.4 seconds and an average fee of 0.00025 per transaction. As a comparison, Ethereum’s transaction time stands at 13 seconds and its average fee ranges from $3-10. Therefore, Solana’s competitive edge, in combination with its ability to seamlessly scale, has resulted in it being seen as a potential all-in-one solution to the future obstacles that crypto ecosystems are likely to face with rapidly growing adoption.

It should also be noted that Ethereum is currently investing heavily in its speed, security and environmental bona fides, and has plenty of resources to do so (it’s currently in the process of switching from a proof of work blockchain to a proof of stake blockchain).

Back to Solana though, Alexis Ohanian, co-founder of Reddit and influential venture capitalist, recently announced a joint $100 million initiative between his capital fund Seven Seven Six and the Solana Foundation aimed at tapping into the potential of decentralised social media that can be created on Solana’s blockchain. “With a high-performance blockchain like Solana, there is an unprecedented opportunity to fuse social and crypto in a way that feels like a social product but with the added incentive of empowering users with real ownership,” Ohanian said as the announcement was made.

Growing utilisation and investments like Ohanian’s in Solana as a major facilitator of Web 3.0 indicate that Solana’s prominence as a technology and a currency may well continue to grow. Its current status as the fastest blockchain in the world (as it claims, anyway) means that its value could also increase rapidly to match its perceived utility as a potentially equal competitor to Ethereum, which is currently valued at over $6,000 AUD.

Ben McMillan, founder & CIO of IDX Digital Assets, an investor who Forbes claims knows Solana well, told Forbes in an article published this month: “As asset managers, we like Solana both as an investment as well as a development platform.”

“We are building our own decentralized apps for investment management functions, and we’re going to move from developing solely on Ethereum to start developing on Solana as well.”

Others still have more faith in Ethereum. Andrey Belyakov, founder of the Opium Protocol, decentralized derivatives network, told Forbes: “Ethereum is the perfect showcase, and I believe that Ether will also become the number one cryptocurrency soon.”

Mashable points out that Solana is less battle-tested than Ethereum, which has been live since 2015.

Mashable reports: “Solana is technically still in beta. This isn’t uncommon for blockchain projects, nearly all of which are experimental in at least some regards. But it’s worth noting that a project is in beta if you’re going to invest, or build an app on the platform.”

Mashable adds: “Solana pays a price for its speed: the validator requirements (validators are computers that help run the Solana network) are very high. While anyone can theoretically run a validator node on Solana, the high cost of building, running, and maintaining such a machine will drive away many users. This theoretically makes the network less decentralized, as more power is concentrated in the hands of fewer users.”

Finally: “This could cause other issues,” Mashable reports. “For example, validator nodes that aren’t powerful enough to handle the network activity could cause slowdowns or instability, and that does occasionally happen on Solana. There could still be undiscovered bugs or issues that could affect the performance or the security of the network.”

RELATED: I Bought $1,000 Of Crypto Currencies. It Was A Huge Mistake

With the value of SOL hovering at around $322 AUD at the time of writing (almost 20 times less than that of ETH, which is currently sitting at $6,453 AUD), it becomes clear why some crypto investors and tech moguls are willing to bet on the future growth of both Solana’s implementation and its value. It appears that Solana has cemented its position as a leading cryptocurrency in 2021. Solana’s next challenge will be to meet the lofty expectations that have been placed on its future development.

Disclaimer: This article is intended for informational purposes only. This is not financial advice. Never invest more money than you can afford to lose into any crypto.