Salomon Brothers, a Wall Street company famous for its excesses and scandals, which has featured in such books as “Liars Poker” and “Barbarians At The Gate,” is now being revived in 2022.

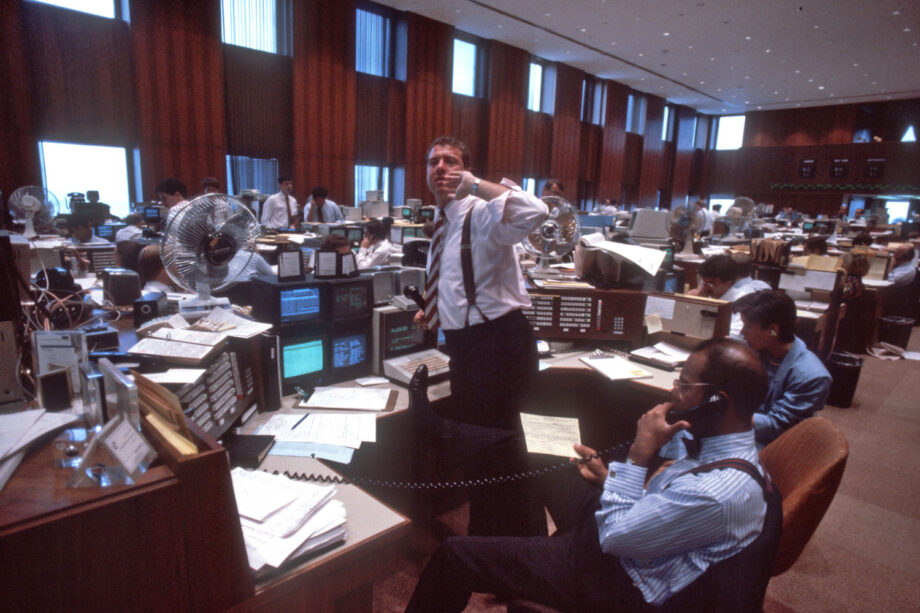

Salomon Brothers was founded in 1910 and was one of the biggest investment banks on Wall Street. It was best-known for its fixed-income trading department. Salomon Brothers went wild in the heydey of Wall Street in the 80s, then became embroiled in controversy and eventually came a cropper in the 90s.

As a result of various controversies, it went through a series of acquisitions and mergers between 1981 and 1997. Eventually, it merged with Citigroup, adopting its name in 2003.

Even since then though, the name “Salomon” has retained a pull. According to Wall Street Journal, even after the merger, investors (as late as 2009) would call Citi and ask for “Salomon.”

Seeking to play off this, a group of former employees is now using the storied name to launch their new firm.

The “full-service investment bank” will target New York State middle market firms and is looking for US $3 million to $300 million in equity capital, according to a public statement. The statement also said Salomon Brothers plans to hire hundreds of staff in the next few years.

Its president, R. Adam Smith, also said: “Salomon Brothers is a legendary name that has a tremendous following” in an interview.

“We have the honor to carry that legacy on our shoulders and to share that with bankers.”

Smith said the idea for Salomon 2.0 happened about three years ago, and that his group acquired the trademark from an undisclosed third party. He didn’t share the terms of the deal.

On Smith’s LinkedIn profile, he says the new incarnation of Salomon Brothers will provide corporate finance and capital market services, and will help New York companies recover from the pandemic.

“Salomon Brothers is an independent investment banking firm. The firm provides corporate finance and capital markets services. It has launched a major initiative to help New York companies recover from the pandemic and its affiliate provides an advanced fintech trading platform to quote New York companies.”

His profile also states: “The modern Salomon Brothers plans to grow rapidly and to honor the legacy of Salomon Brothers that as founded in 1910 and was once one of the largest Wall Street bulge bracket financial service companies. For over 25 years that firm was consistently among the top ten in the league tables for banking and capital markets. The firm was combined with Travelers in 1998 and eventually merged with Citigroup.”

He adds: “Today, the modern Salomon Brothers is an independent firm that is unaffiliated with any bank. With over 7,000 living alumni, many who are top in their field, the firm plans to grow rapidly. We are determined to see the Salomon Brothers name again at the top of the rankings.”

This isn’t the first time modern bankers have looked to leverage history to gain an edge in the contemporary market.

As Fortune reports, “Kingswood Capital Markets purchased the trademark for the name of famed brokerage EF Hutton last year so it could rebrand. Meanwhile, investment bank Independence Point Advisors jokingly used the code name ‘Salomon Sisters,’ referencing both Wall Street history and the fact that the firm is primarily owned and managed by women and minorities.”

Read Next

- I Bought $1,000 Worth Of Cryptocurrency. It Was A Huge Mistake

- ‘Costly’ Crypto Tax Mistake Catching Australian Crypto Investors Unaware