A wise investment-guru once said, “If you try to pick bottoms, you’ll get a smelly finger”. And despite global share markets falling 38% over the past four weeks, now might be one of the best times in the past few years to invest in shares.

Some investors are concerned the market may fall further and they’d like to delay their investment until some (usually undefined) point in the future.

These punters may well end up being right when we look back in history, however, it’s my experience (and it’s backed up by the academics) that those same people often never end up buying. These bears remain pessimistic, eventually missing the inevitable, highest-return moments, before falling into the stubborn mindset of “I’m not buying above what I sold for”.

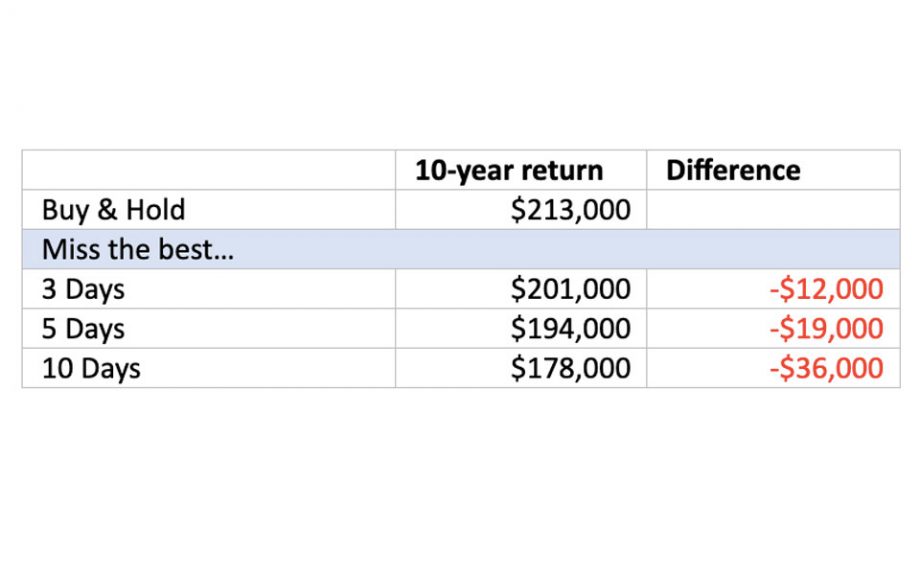

The data is clear, trying to time the market has a tangible cost. The below table shows your total return on the ASX 200 (incl. of dividends) over the last 10 years to 31 December 2019. It also shows what it costs you if you miss out on the best 3, 5 and 10 days in that 10-year period, starting with an initial investment of $100,000 (rounded to nearest thousand).

My point is, imperfect execution of a market timing strategy may cost you more in the long run (if you want to read more about the pitfalls of trying to “time the market”, can I suggest you check out Nick Maggiulli’s blog, Of Dollars and Data).

So: what can you do, then? Start to invest! Acknowledge you’ll never know what share prices are going to do in the short term and it doesn’t matter! Focus on the long term, intrinsic value of the businesses you choose to invest in and what you can do to add to your nest egg.

A common and successful approach is dollar-cost averaging. That’s a fancy way to say, dribble your money in at regular intervals of time (i.e. weekly, monthly, quarterly) and continue to add to your investment as you save.

This takes the emotion out of deploying capital and prevents your future returns being heavily biased by when you luckily/unluckily parted with your cash. It also means you’ll be at least partially invested on the best days in the future.

What should you buy? If you know what you’re doing or prefer to go it alone, a common strategy is to simply invest in the brands and products you know and love.

Companies like Nike, Louis Vuitton Moet Hennessy, Spotify, Apple, Gucci’s parent company Kering and/or Paypal for example, all trade on global exchanges every day. Alternatively, outsource the work to a registered investment advisor (like me) and they can assist you in building a portfolio that meets your personal needs, objectives and risk profile.

They’ll also be there to help you manage and track your investment in a tax-effective way.

Or just buy some broad-based market exposure using an Exchange Traded Fund (ETF) that will closely track one of the many stock market indices around the world. Some of the major indices include the ASX 200, the S&P 500 and the MSCI All World Index.

Regardless of what you choose, you’ll need an account with a stockbroker or intermediary with access to local and international shares. This might be available through your bank (Commsec, NABTrade etc.) or you might like to drop me an email ([email protected]) and our team at Seneca can help you make a start.

This article is of a general nature only and does not consider your objectives, financial situation or needs. You should consider the appropriateness of the information in light of your objectives, financial situation and needs before acting on it and obtain copies of any relevant disclosure documents. Seneca Financial Solutions does not warrant the accuracy or reliability of the information in this report.

Luke Laretive, Seneca Financial Solutions, it’s Directors and it’s associated entities may have or had interests in companies mentioned. They may have or have had a relationship with or may provide or has provided investment banking, capital markets and/or other financial services to those companies mentioned.

Luke provides clients with a daily note, which you can access here.