From marrying well to investing wisely (to deciding to stop buying pre-workout), Australians are today taking to Reddit to share the best financial decisions they ever made.

Have you ever got to the end of the month, only to look around and think: “where on earth did all my money go?” If so, this right here is an article you might want to read. Though some of the suggestions are tongue in cheek (or should we say ‘ring on finger’), some are quite interesting.

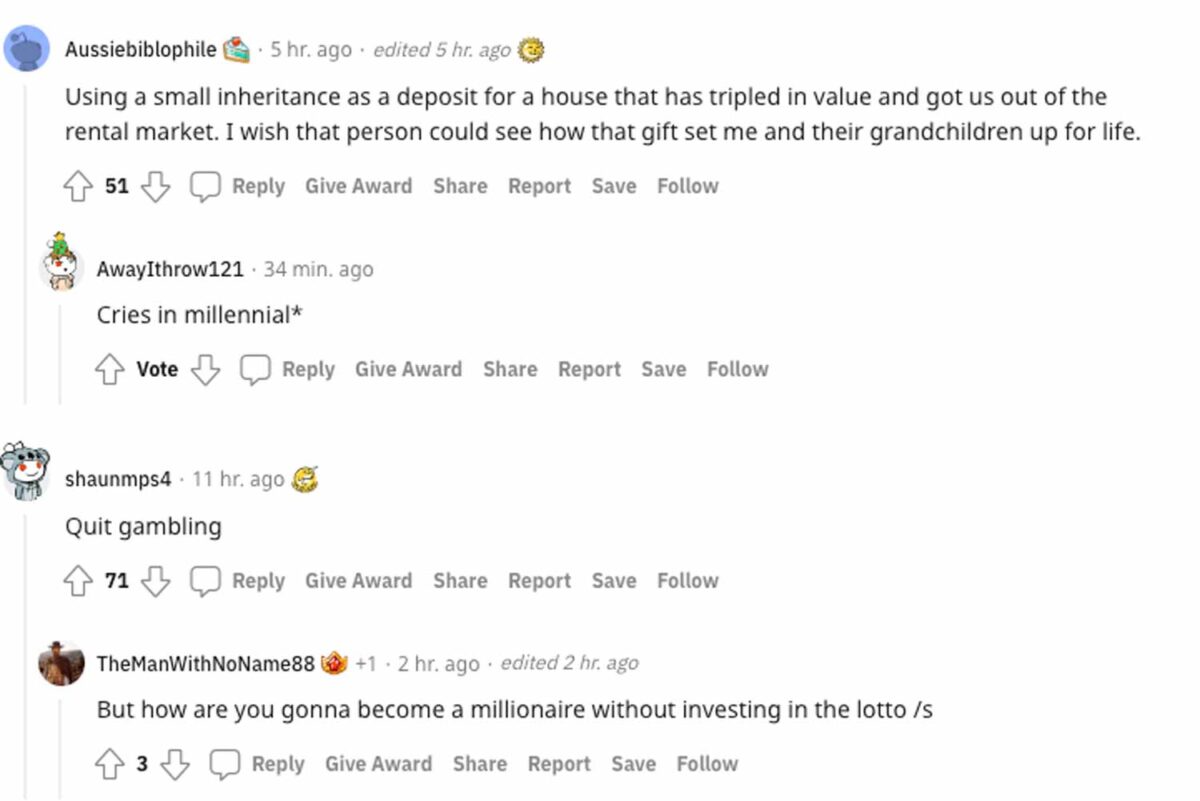

Overnight, a Reddit user posted the following question to Reddit’s r/AusFinance community: “What is the best financial decision you have ever made?” Australian netizens were quick to respond. The answers ranged from sharing how their love lives turned out to be quite profitable, to revealing how certain investments had paid off.

One Reddit user said the key to becoming rich is to wed well. He simply responded: “Marrying my wife” to the question posed. Others said the key was staying married (“only second in importance to ‘staying married to my wife’ another user quipped).

“Yup. And importantly, marrying someone with the same views when it comes to handling money.”

The conversation also delved into, as it always does in Australia, real estate. One Australian finance enthusiast said they were glad they pulled money out of their super to buy a place before retiring. They wrote: “Buying my unit using super just before retiring and paying off all debts. Don’t have much money but regard myself rich.”

Though pulling money out of your super is known as risky, another user expressed their support for this move, writing: “This is the way. Easier to have that security and live off rice and lentils than to have more income but worry about renting as a 90-year-old, IMO.”

RELATED: Australia’s ‘House Porn’ Obsession Can’t Be Stopped

Other members of the r/AusFinance community talked about mortgage rates – and how they were glad they fixed them. One wrote: “Used westpac so that I could lock in my interest rate (2.29%) during construction of my property, locked in for 4 years because I just didn’t believe rates were going to stay low. Got insanely lucky. Also stopped buying 300 dollar bags of pre workout.”

Further financial decisions that were looked back on fondly included paying off credit card balance each month without fail, not having a credit card, reading The Barefoot Investor, making a point of “educating myself as much as possible,” getting out of the rental market and quitting gambling.

Another couple of responses were: “Spending within my means and only ever borrowed money to buy a home. Due to this, retired mid 50’s” and “stretched myself to the max to buy our house, and it was a stretch.”

The same user continued: “Nothing else I have done has financially come close to increasing my net worth by as much. Sure I need to live somewhere but later on in life I can downsize and release some of that equity.”

“More importantly than the financial value though.. nothing else I have done in my life can even come remotely close to giving me the same feeling of security and stability as knowing I have secure place to come home to, I can do my own improvements, and not worry about landlords selling on me etc.”

Well, now we know where Australia’s obsession with the property market comes from…

Read Next