- CRO is the native token of Crypto.com — a market-leading cryptocurrency exchange app and payment platform and is the 17th largest cryptocurrency by market cap.

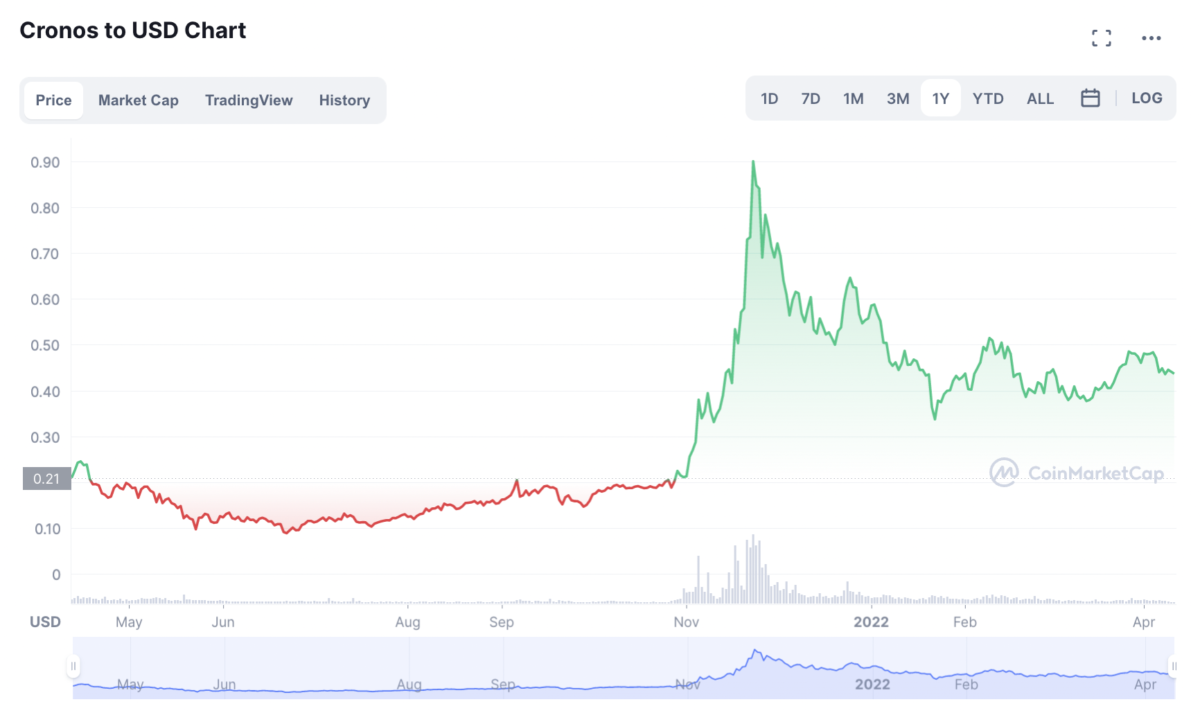

- CRO began to attract the attention of crypto investors in November last year, after rallying over 400% in under a month on the back of an NBA naming rights deal that saw the Staples Centre renamed as the ‘Crypto.com Arena.’

- The ‘Crypto.com’ token (CRO) was recently renamed ‘Cronos’, reflecting Crypto.com’s move towards a larger decentralized ecosystem — focusing on DeFi, NFTs and the metaverse .

- Most experts are quite bullish on CRO, as the token’s value is supported by a growing underlying business that is leading the charge of mainstreaming cryptocurrency adoption.

The price of CRO has consistently tracked movements of the broader crypto market during the recent market slide and is down 31% year-to-date. CRO currently trades for US$0.43 ($0.58 AUD) per token and is ranked as the 17th largest cryptocurrency by market cap — valued at a respectable US$11 billion ($14.8 billion AUD).

Table of contents

What is CRO?

To clear up any confusion moving forward, what was once called the ‘Crypto.com token’ (CRO) has been recently renamed to ‘Cronos’. On February 18, Crypto.com went ahead with the name change, not just as a branding move, but to demonstrate that the Crypto.com organization is making serious progress in creating a larger decentralized network that may eventually compete with the Binance Smart Chain and potentially even the Ethereum network.

Cronos belongs to a class of digital assets known as “utility tokens” — which means that it is used to pay and validate transactions on the Crypto.com Network. Users of the Crypto.com app are incentivised to buy, hold and stake their CRO to receive rewards, and even gain access to the crypto.com debit card.

CRO Tokenomics

Cronos is a non-mineable, limited supply token with 30 billion tokens in circulation. CRO is also a deflationary token, meaning that the total number of Cronos tokens decreases over time. This generally tends to have a positive impact on price long-term, as the total number of tokens become more scarce.

It is important to note that 40% of the total supply has been locked until the 7th of November 2022, meaning that investors can expect the price of CRO to be diluted in the mid-term when these tokens once again become available on the market.

Crypto.com Overview & News 2022

Founded in 2016 by now-CEO Kris Marszalek, Crypto.com is one of the world’s largest exchange apps, boasting over 10 million users. The Singapore-based exchange is responsible for the world’s largest cryptocurrency card program, after announcing a global partnership with card-payment provider VISA in March last year.

In addition, Crypto.com have recently launched its own premier NFT platform, alongside its new smart chain called ‘Cronos Chain’ which aims to make the entire organization more decentralized and allows for DeFi projects and DApps to be built on a CRO-native network for the first time.

CRO Short-Term Price Prediction (1 month)

Despite the recent rebrand to Cronos and with Crypto.com arguing that the Cronos chain is faster than the Ethereum network, CRO has remains down 25% YTD.

Analysts at FXStreet are relatively bullish on CRO in the short term, expecting the price to rise from its current price of US$0.43 ($0.58 AUD) to US$0.46 ($0.62 AUD) over the next few days, a comfy 7% increase in the short term.

Contrastingly, analysts from Central Charts have a more bearish outlook for CRO in the short-term, predicting that if CRO continues its downtrend from here then CRO may be expected to reach a new yearly low of US$0.33 ($0.46 AUD) for the token.

CRO 1-Year Price Prediction (2022)

Like most other cryptocurrencies at present, mid-to-long-term technical analysis from both TradingView and CoinCodex remains bearish, with most indicators leaning towards a negative price sentiment for the coming months.

The overall analysis of CRO remains bullish for the long-term with automated analysis from WalletInvestor predicting that CRO could feasibly reach a price of US$0.95 ($1.31 AUD) by the end of 2022.

Analysis from DigitalCoinPrice is slightly less bullish and predicts that CRO will be worth US$0.57 ($0.80 AUD) by the end of this year. Additionally, CoinQuora suggests that an end of year price target of US$0.97 ($1.35 AUD) is still on the cards. Finally, analysis from Gov.Capital predicts that CRO will finish the year at a price of $0.87 ($1.21 AUD).

CRO 5-year Price Prediction (2026)

Automated analysis from Wallet Investor states CRO could be valued at US$2.92 ($4.08 AUD) in the next 5 years, provided that current long-term macro trends continue.

Gov.Capital’s algorithmic predictions are slightly less bullish than Wallet Investor but still put BNB at a value of US$2.77 ($3.88 AUD) come 2026.

How to Buy CRO

So, if you decide to go ahead and purchase CRO you can do so on most major crypto exchanges. Unless you are already extremely comfortable with a certain exchange or platform, the best place to purchase CRO is on the native Crypto.com app itself, as Crypto.com will charge users lower fees and offer incentives for everything involving CRO.

CRO Price Prediction Conclusion

- CRO token (Cronos) has an extremely solid & sustainable foundation for growth and strong performance in the wider crypto market. Because CRO is a high utility token with some of the most impressive real-world use cases, it is arguably one of the more high-growth crypto assets to invest in.

- Currently, Crypto.com is the only large company with products that solve the most irritating and counter-intuitive problem with the crypto market today — actually using crypto as a currency.

- What makes CRO attractive to investors is that despite being the 17th largest cryptocurrency, it still has a good deal of room to grow. If CRO were to reach the size of a similar utility token such as Binance Coin (BNB), which has a market cap of $62 billion ($87.6 billion AUD) — CRO would grow a further 590% from here.

- Even if CRO doesn’t ever “moon” from here, it has all the necessary fundamentals to grow sustainably into the future. Investors should keep a watchful eye on all updates regarding broader crypto regulation as the price of CRO is particularly vulnerable to events that disrupt the performance of Crypto.com and its financial activity.

RISK STATEMENT:

This article is of a general nature only, and is intended for solely informational purposes.Crypto markets are substantially more volatile than that of regular finance, unexpected and dramatic price movements are bound to occur. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next: