Some investors are looking to beef up their portfolios now that McDonald’s cult favourite menu item the McRib is back.

Others have already done some shovelling, with the move, to some degree, already being priced into the market.

But is this astrology for investors or a real thing? First, allow us to explain what the McRib is. The McRib is boneless pork ribs on a burger type thing. It was first added to McDonald’s menus in 1981 around Kansas city, but was pulled from the menu four years later.

Since then it has become a weird kind of cult favourite. And after years of lobbying and requests on the internet and social media, it has gained something of “icon status.”

Thanks to that, it has been reintroduced to the menu, sporadically, to please these loyalists, as well as because it sometimes commercially suits McDonalds. As Alexander Chernev, a professor of marketing at Northwestern University’s Kellogg School of Management told CNN: “When you have these exclusive products, which exist for a short period of time, it gives people a reason to come to the store.”

According to James Whelan, Investment Manager at VFS Group in Sydney, there is another reason you should be paying attention to McDonalds’ occasional re-introduction of the McRib.

Mr Whelan told DMARGE that the “McRib index” can actually tell you something about the stock market.

Mr Whelan explained that, in a sense, “McDonalds is not a fast-food chain so much as a major commodities purchaser.”

“Imagine how much beef they need to fill their burgers; imagine how expensive that is.”

“Now imagine there’s an alternative.”

“You can’t change how much you charge for a Big Mac; you’ve got to keep it pretty stable over time. But the price of beef does go up. There’s only so much you can hedge before it gets too expensive to hedge.”

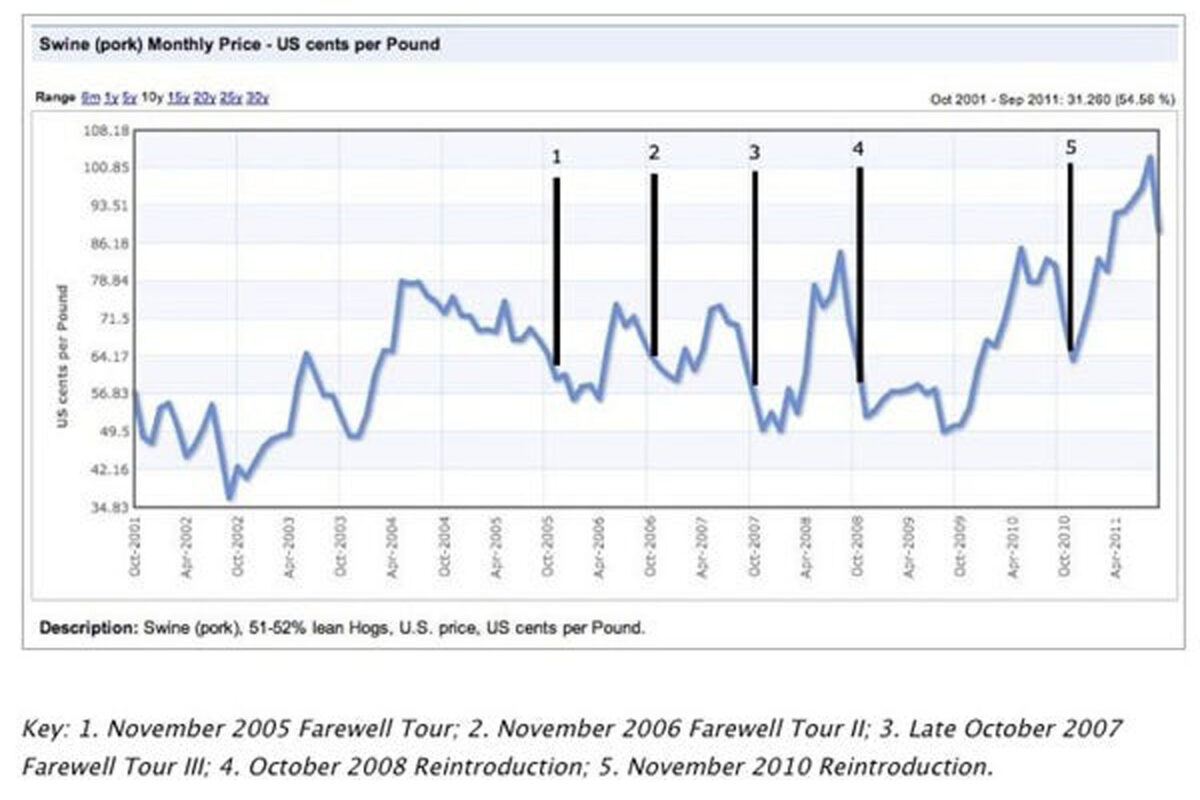

Mr Whelan continued: “The McRib was originally unpopular [then] started to move up in popularity. But here’s the thing: every single time the McRib gets offered by McDonalds it’s an indication to show that actually pork prices are at a low because you need to lock in that much pork to feed a hundred million people who need to eat something.”

“It also means for every person who buys a McRib – that’s one less person who’s going to buy your Big Mac. This is great [for McDonalds] because [during times when the McRib is offered] beef is really expensive and you’ve got to stock that beef and keep it frozen. So you’re saving on the beef and you’re saving on the pork. Fantastic.”

Mr Whelan then explained the McRib index – a metric which has certain groups in such places as Reddit frothing and theorising (in one Reddit trading community, a community member started a thread two months ago, when McDonald’s announced the McRib would be on the menu, entitled: “The McRib Index Is Flashing”).

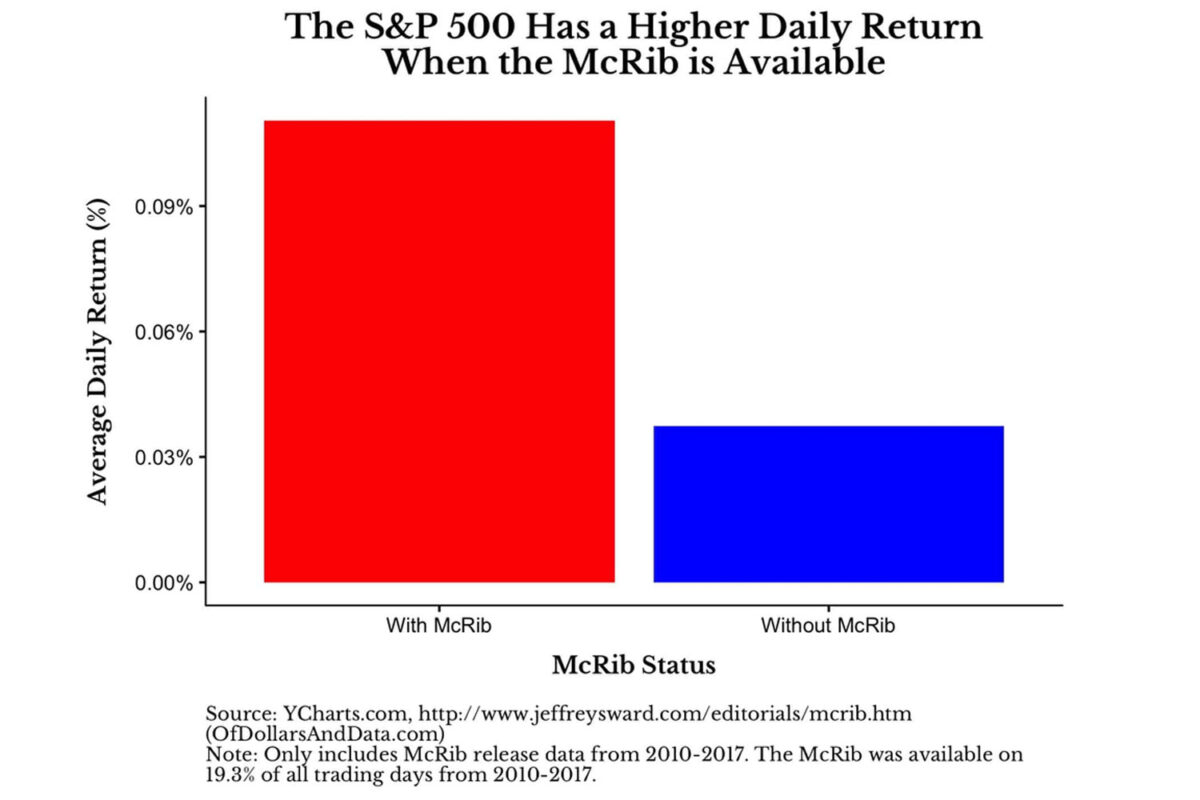

The McRib index can be seen in the above graphic – over a 7 year period from 2010 to 2017, every time the McRib has been available, the S&P 500 has had a higher daily return than when it was not available.

Though this is not a direct correlation, it is interesting for a number of reasons.

“Is there something that you can pull out of the market that when pork is low and beef is high (and when McDonalds decides to launch the McRib)? What is it about this particular time in the cycle? When the McRib is available in the US the average daily return of the S&P 500 is 0.1% – which is pretty good,” Mr Whelan told DMARGE.

“When the McRib isn’t offered it’s only 0.03%.”

That’s three times as much per day when the McRib is offered.

Mr Whelan also shared that he thinks there is going to be a food crisis next year, thanks to the La Niña climate leading to wet weather (on the whole) for Australia and dry weather for America, which leads to food scarcity and a need for fertilizer (and, by extension gas, which is used to create fertiliser).

Looking at financial markets as a whole, Mr Whelan also told DMARGE that though there are a lot of indicators that are flashing red, we’ve still got a Fed and reserve banks all around the world “conditioned to stimulate markets” and still got “money sloshing around.”

“As much as tapering is in play they haven’t pulled that rug away.” In other words: for now, there’s no need to worry too much about the red flashing lights that some believe could signal a crash should occur, for the time being.

RELATED: Why The Stock Market’s Stunning Recovery Might Not Have To End

There you go. Some food for thought.