Have you heard about PayID but still aren’t sure what it is or if it’s safe? Or have you just arrived in Australia and have no idea what someone means when they ask “have you got PayID?” Allow us to explain all.

Transferring money to friends and family is something of a common occurrence. If you’ve been out to a meal with a large group of people and you want to transfer your share to the person who paid, PayID makes it incredibly simple. This is because uses the person’s phone number to find their account details.

All you need to do is enter their mobile phone number, select how much money you want to send and boom, it’s done.

Still confused? Don’t worry. In this guide we’ll explain what PayID is, how it came to be, which banks support it, how to use and more.

In this PayID guide…

What Is PayID?

PayID is a form of digital identification, unique to you, that you can use to accept monetary payments from someone else. This form of ID can be your phone number, an email address or an ABN if you’re a sole trader with a business banking account.

PayID is the unique identifying information that Osko uses to make near real-time payments.

PayID was released on February 13th 2018 as part of the New Payments Platform in Australia. The NPP is an industry-wide payments platform that incorporates both PayID and Osko.

Since its launch, PayID has been adopted by more than 60 Australian banks and more than 100 Australian banks use the NPP payments platform.

How To Set Up PayID?

If you haven’t already set up PayID within your particular bank’s smartphone app, then you will to do this first. The exact set-up process may differ from bank to bank, but on the whole, you should be able to find PayID settings within the ‘My Account’ section of your bank’s app.

We’ll use the CommBank PayID set-up process as an example of the steps you need to take.

- Open the CommBank app and sign in to your account

- Press the button in the top left of the screen. It will either have an image of a small person or will show your initials

- Once in your Account section, PayID will be presented as a clear option, alongside your Personal Details and your Tax File Number information.

- Press the PayID icon and you will be taken to the PayID settings screen

- From here, press “Add a PayID”. You can then choose to use your phone number and/or email address to be used as your PayID.

- That’s it, your PayID is now set up

How To Use PayID?

The exact method for using PayID will depend on which Australian bank you bank with, as the process within the companion smartphone application could be slightly different.

For the majority of cases, however, you will want to complete the following steps (we’ve used CommBank’s PayID payment process as an example):

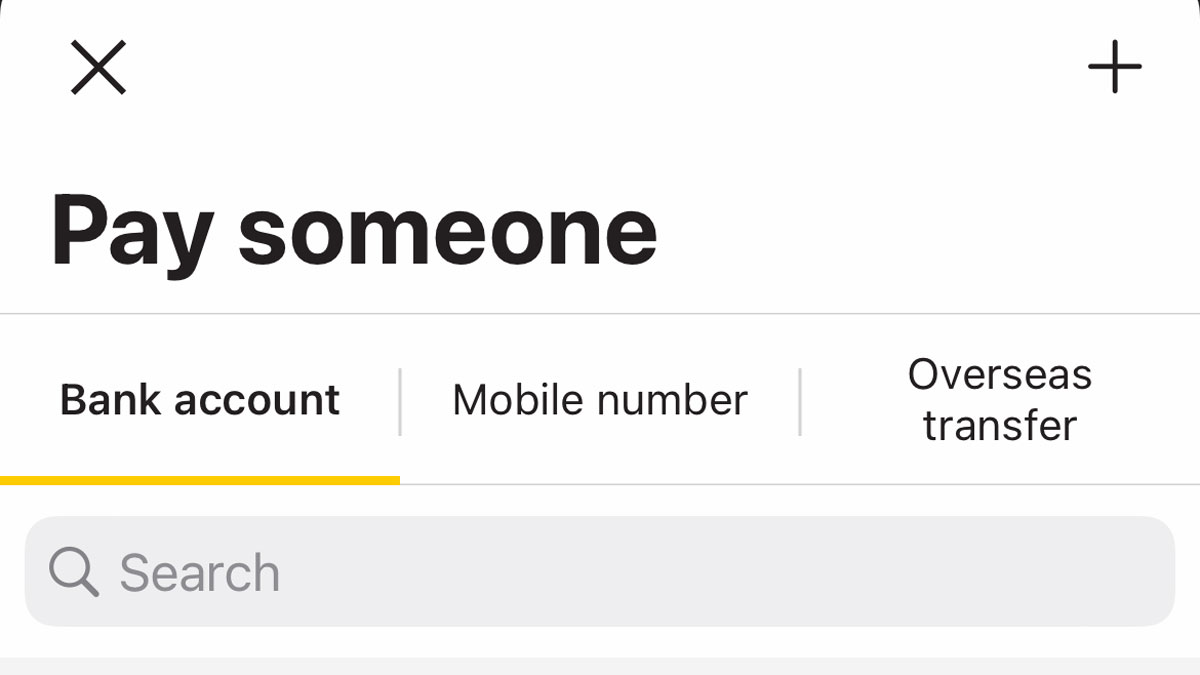

- Click ‘Pay’ from the home screen of your banking app and then select ‘Pay Someone’

- To find someone saved in your contacts to pay via PayID, press ‘Mobile Number.’ This then brings up a list of contacts saved on your phone.

- Find the contact you wish to pay and select them

- You will then be presented with that person’s PayID details, including their name and mobile number. Confirm these are correct before proceeding

- On the next screen, simply enter the amount of money you want to send your contact, and enter a description. You have a 280-character limit

- Click ‘Next’ in the top right of the screen and your payment will be mad

If you want to pay someone via PayID who isn’t stored in your contacts, then you just need to do something slightly different.

- After selecting ‘Pay Someone’, you will need to press the ‘+’ icon in the top right of the screen

- You will be asked which PayID method you wish to use: Mobile number, Bank account, Overseas transfer or more (the ‘more’ section is where you can find someone to pay via email address, ABN or organisation ID).

- Select Mobile Number

- Enter the recipient’s Australian mobile number and press ‘next’

- You will be asked to confirm the account details associated with the mobile number you’ve entered

If you want to send money using PayID to a business or a sole trader, just follow the same steps as those above, but select the ‘More’ option after the ‘+’ and select ABN or Organisation ID.

Now, when someone wants to pay you using PayID, they will just need to enter either your phone number or email address (whichever you used to register for PayID) and they will instantly find your bank account details.

The other person enters the amount of money they wish to send you and then it is sent in real-time via Osko, and should appear in your bank account immediately. If the money doesn’t appear in your bank account immediately, don’t worry, some banks can withhold payments for security checks before approving the payment.

How Long Does PayID Take?

With the majority of PayID transactions, any money you send to someone else, or any money you receive, should arrive instantly in the recipient’s bank account.

If, however, you’re sending money to someone for the first time, your bank may hold the payment for security checks. This can depend on the bank you’re with, or the bank the recipient is with. If payment is held, it should be processed within 24 hours.

Which Banks Support PayID?

The vast majority of Australian banks support PayID or Osko. However, in some instances, a bank may support Osko, but not PayID. Current banks that support PayID include:

- ANZ

- Australian Military Bank

- Australian Unity

- Bank Australia

- Bank First

- Bank of Melbourne

- Bank of us

- Bank SA

- BankVIC

- Bankwest

- BCU

- BDCU Alliance Bank

- Bendigo Bank

- Citi

- Coastline

- CommBank

- Community First

- Credit Union SA

- Defence Bank

- Easy Street Financial Services

- Family First Credit Union

- Firefighters Mutual Bank

- G&C Mutual Bank

- Goulbourn Murray Credit Union

- Greater Bank

- Great Southern Bank

- Horizon Bank

- Hume Bank

- Hunter United

- Illawarra Credit Union

- imb Bank

- ING

- ME

- MOVE

- MyState

- NAB

- Newcastle Permanent

- Northern Inland Credit Union

- Orange Credit Union

- P&N Bank

- People’s Choice Credit Union

- Police Bank

- Police Credit Union

- QBANK

- Qudos Bank

- Queensland Country Credit Union

- Regional Australia Bank

- Reliance Bank

- Rural Bank

- Service One Alliance Bank

- South West Credit Union

- St. George

- Suncorp

- Teachers Mutual Bank

- The Mac

- The Mutual

- UniBank

- Unity Bank

- Ubank

- UP Bank

- Westpac

- 86400

PayID & Crypto

Not only can you use PayID to transfer money between friends, family and businesses, but you can also use it to buy cryptocurrencies in Australia. In order to use PayID to buy cryptocurrencies, the crypto exchange you buy your crypto through needs to accept the platform as a payment option.

Crypto exchanges that accept PayID in Australia include:

Read Next