If you’ve invested any amount of money in Australia’s once-booming buy now, pay later (BNPL) sector over the last year, you’re probably still wincing every time you open up your portfolio.

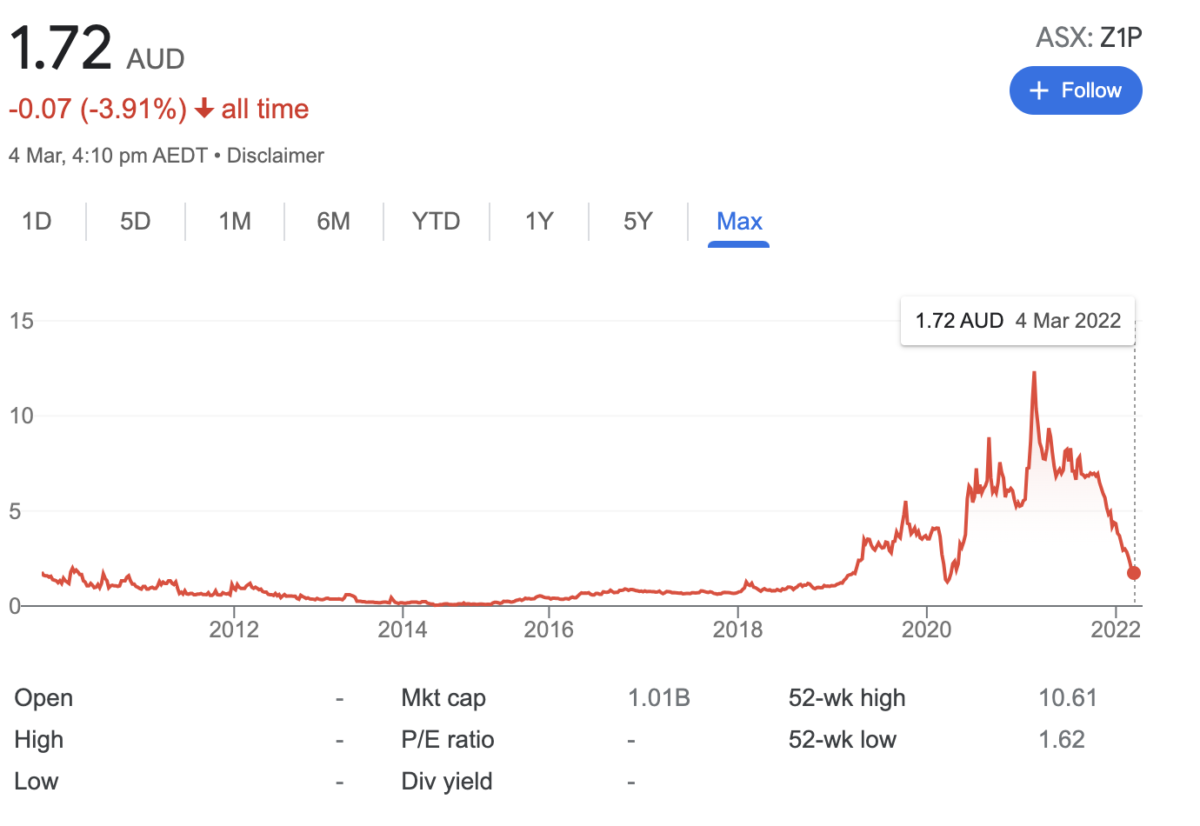

This is particularly true for anyone that bought shares in former Aussie market-darling Zip Pay (ASX: Z1P) which is currently trading for $1.72, down over 80% from its all-time high of $12.50 in February last year. So, what actually happened to Zip Pay and the Australian BNPL sector. How did Zip and the entire sector collapse in such spectacular fashion and can investors expect prices to recover any time soon?

According to the managing director of Payment Services and payments industry expert Brad Kelly, Zip Pay and the remaining Aussie BNPL providers are set to experience an “implosion” throughout the remainder of this year.

This is because every single BNPL company in Australia, including the market leaders: AfterPay (now owned by Block) and Zip Pay are yet to turn a profit or pay a dividend. Making things worse, the companies have been running heavy losses and stacking up massive debts for years.

Kelly warned investors that BNPL companies are extremely good at marketing and hyping up their products, but ultimately the numbers are not in their favour:

“The BNPL as an industry in Australia had total sales of $11.4 billion last year compared with credit and debit cards which came to a total of $750 billion. This gives the BNPL sector a market share of card payments of only 1.5% after 8 years of operation. These businesses are tiny and they are not the chest beating, bank killing giants that they pretend to be.”

Kelly continued his warning for the industry:

“BNPL is not the next big thing in payments, nor is anyone cutting up their credit cards and moving to Zip or the others. That is just nonsense. BNPL is a feature, not a stand alone product. The pressure on the remaining players will be immense as interest rates rise, and investors expect profits, not hollow promises. Most will not survive.”

So, if you’re thinking that now is the perfect time to load up on some discounted Zip shares as the company reaches new yearly lows and headlines from the AFR tout the recent merger between ZIP and Sezzle as a boon for business, it might be worth approaching with caution.

“Zip buying Sezzle is the same as the Titanic buying the Hindenburg — two big disasters together just makes one gigantic disaster.”

Taking two unprofitable businesses with very small revenue per customer and bolting them together ($4.50 per month per customer for Zip and around $2.60 per customer per month for Sezzle) is not going to achieve very much, except drag out the process of slowly going bust – that argument goes.

When asked if there was any chance that Zip or any of the other providers could expect to recover in the coming months, Kelly answered bluntly:

“That’s not going to happen. 70, 80, 90% of your share price isn’t going to be recovered when there is simply no pathway to profit… Neither business [Zip or Sezzle] has turned a profit and never will.”

Read Next