When you think about the cryptocurrency galaxy, there are a few big names blazoned across the sky – among them Bitcoin, Ethereum and Dogecoin.

Even recently there has been a big upstart in the form of the mysterious Shiba Inu – another meme coin which aims to take Dogecoin’s mantle as the greatest groupthink experiment in existence.

Speaking of lesser known block chain projects, allow us to introduce you to another: Cardano. Cardano (ADA) popped up in August to become the third-largest coin after Bitcoin and Ethereum, as investors looked for more climate-friendly crypto currencies in the wake of Elon Musk’s criticism of Bitcoin on SNL.

Watch Elon Musk and Mark Cuban discuss the potential applications of Dogecoin in the video below.

Cardano seems to have a greater use case than Shiba Inu, and had been ticking over for a while before people started jumping on the hype train. So, what the heck is it?

Cardano is a blockchain platform and it has its own internal cryptocurrency called ADA (named after Ada Lovelace, a 19th-century British countess known for her work on a theoretical computation engine, who also was the daughter of Lord Byron). Cardano was founded in 2015 by Ethereum co-founder Charles Hoskinson. Cardano was officially launched in 2017.

In short: a blockchain with a flexible network and fast transaction speed, which mean it’s (compared to many other big coins like Bitcoin) highly scalable and sustainable. It’s also the crypto currency held by the greatest number of Australians, according to a report by Finder.

The Australian Information Service provider (Finder) recently announced a number of interesting findings, which they gleaned by surveying 1,003 adults in Australia. Finder found Australia ranks 3rd in the list of countries studied for ownership rate of crypto.

Australia’s crypto ownership rate, according to Finder’s study, came out 17.8%. This is ahead of Indonesia (16.7%) and Hong Kong (15.8%) and significantly ahead of the global average of 11.4%.

Finder’s biggest four findings were as follows:

- Australia has the 3rd highest rate of cryptocurrency ownership in Finder’s survey at 17.8%

- Of those that own crypto, more than half (65.2%) own Bitcoin – the 5th highest percentage of all 22 countries

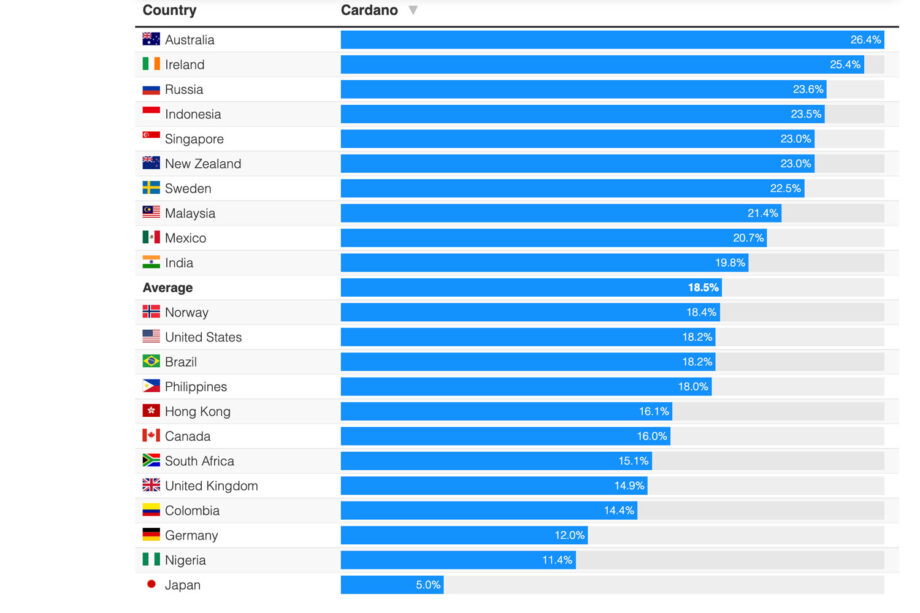

- 26.4% of Australian crypto owners hold Cardano, the highest percentage globally

- Men are 1.5 times more likely to own cryptocurrency than women

Finder also revealed: “Of the nearly 1 in 5 adults in Australia who own some form of cryptocurrency, Bitcoin is the most popular coin for Australians at 65.2% of crypto owners.”

The second most popular coin in Australia was found to be Ethereum, at 42.1%,, while Cardano came in at in third place, with 26.4% of Australian crypto investors owning some.

Finder added: “Cardano is the third most popular choice with crypto adopters in Australia, with 26.4% of adults who own crypto holding the coin. This makes it the highest-ranked country in our list of 22 countries in terms of Cardano ownership among those that own crypto.”

“Cardano sees its peak in adoption in Australia,” Finder wrote, “where 26.3% of the online population who own crypto say they have Cardano, which is 1.4 times the global average adoption rate of 18.5%.”

Maybe the sustainable ETF hype (over in the traditional finance world) is rubbing off on us?