The only thing worse than a Steve Jobs fanboy is an Elon Musk fanboy.

That’s what I would have told you in 2018.

Fast forward to June 2021 and – though rolling up to a date in a Tesla Model 3 (while chatting to your Reddit bros through your AirPods) is still probably the world’s most effective contraceptive for men – more and more people are becoming crypto-curious.

Internet punters are proudly identifying as “idiots” (and making crazy amounts of cash) and institutional investors, seeing the insane gains being made out this mass delusion, are being tempted into the waters, in a move that has provided the sector with long-awaited legitimacy, as part of a grand scheme to overhaul the entire financial system, rewarding the heroes brave enough to get in first…

That’s what hardcore cryptocurrency advocates want you to believe, anyway.

Though many experts see it more as a glorified Ponzi scheme with some potential to do good (even the founder of Ethereum, Vitalik Buterin, recently played down cryptocurrency’s ability to radically solve the world’s problems on the Lex Fridman podcast), what’s not up for debate is that the sector has been trending hard in the news.

Why? Everyone wants to get rich quick.

Alongside the work from home revolution (and loneliness crisis) of 2020, Bitcoin quadrupled in value. Meme-coins like Dogecoin have blown up too.

This has happened as online communities straddle murky waters, where genuine friendships appear to be built between users with a common goal of getting rich quick. The problem? One never knows how much of this is real friendship, and how much of it is purely designed to manipulate vulnerable, lonely people into trading their money for hot air.

The cynics would say it’s all cupboard love, the proponents would say there is a real sense of community – a real bonding over a common disenfranchisement with the traditional finance system – even if everyone involved is aware there is no true value to the coin they are buying, beyond the hype.

In any case, the sector is booming in the public imagination, fuelled by success stories, and the fact that no one hears about the other thousands of people who lost money.

As CNBC reported in May, “A $1,000 dogecoin purchase on Jan. 1, 2021 – at a price of less than a cent per coin – would be worth $121,052 at Wednesday’s high of 69 cents, a gain of more than 12,000%.”

“That’s significantly more than other cryptocurrencies like bitcoin and ether, which grew 95% and 369% over the same time period, respectively. A $1,000 bitcoin purchase would be worth $1,953.88 as of Wednesday, while ether would be worth $4,686.58.”

It was in this environment that I decided to cash in on the hype. After all: if there are two things you can count on in life, it’s human greed and stupidity. Right? So on May the 11th, I bought $1,000 worth of various cryptocurrencies, for the sake of journalism…

Though many in the world of traditional finance are giving the crypto sector a wide berth for fear of giving it legitimacy, I thought I would dip a toe into the waters and attempt to provide a non-judgemental, non-patronising (but also, hopefully, a non-shill) take on what it’s like to invest in crypto currency in 2021 as a complete rookie.

RELATED: Australia’s Liberal Stance On Crypto Currency Puts America To Shame

To do this, I split my money between stalwarts Bitcoin and Ethereum, as well as a bunch of highly speculative joke coins, group-think schemes and newcomers like Dogecoin, Shiba Inu, Safemoon, Revain, Astro Pup and AC Milan Fan Token.

Before you throw your Australian Financial Review at my head and accuse me of giving scammers the hype they crave… hear me out. If I’m dumb enough to get sucked in; I’m probably not the only one. So consider this a public service announcement.

Anyway: with the disclaimer that this is not financial advice, and that if you want to actually keep your money you are much better off intelligently investing in property, ETFs or a well-rounded stock portfolio… here’s the story of how I spent $1,000 trying to take on the world of cryptocurrency degenerates – and your guide in what NOT to do with your hard-earned cash.

I don’t advise you to take on the world of sh*t coins (as part of my experiment comprised), but if you do, at least learn from my errors.

The experiment was simple: I took $1,000 and put it into a mix of random speculative cryptocurrencies, as well as a couple of well-known ones, and observed the impacts (on both my bank balance and emotional state) of joining these new online cults.

In the interests of sociological accuracy, I did not keep my experiment scientific. Much like the rest of the world, I allowed greed to overtake me.

Though I intended to put $100 into each coin I soon found myself believing I could pick the eyes out of the market, and began throwing a little more at some, and a little less at others.

Here’s what went down.

Results

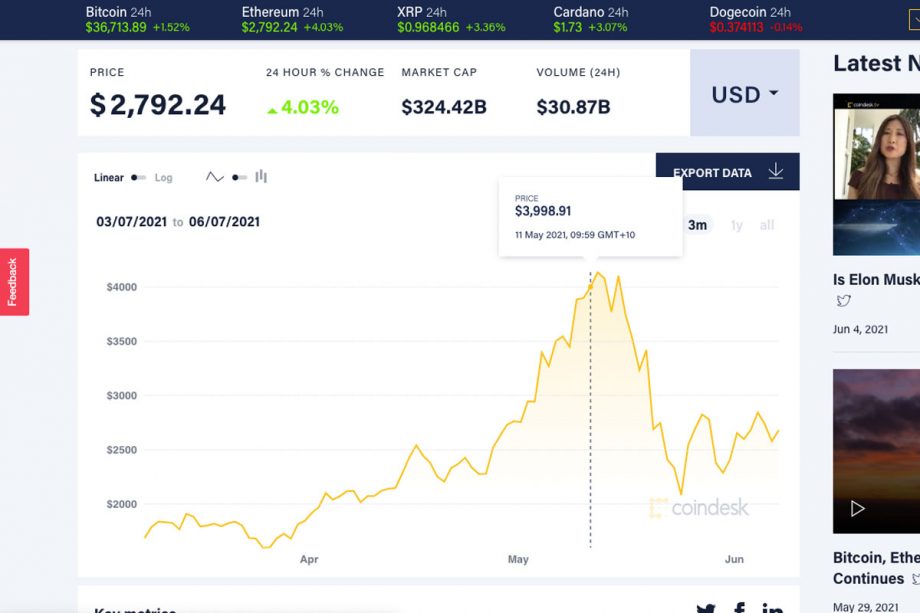

Bitcoin

I bought $500 of Bitcoin on CoinSpot on the 11th of May thinking “here’s a safe bet.” It turned out to be one of my worst performers. Shortly after I bought in, Elon Musk announced Tesla would no longer accept Bitcoin as payment (citing the environmental impact of mining), cracked some quips on a talk show (and China cracked down on Bitcoin mining), and now my investment is worth less than half what I put in ($180).

Dogecoin

My $100 Dogecoin investment also tanked alongside Bitcoin after derogatory comments from Elon Musk on SNL went viral. It has recovered better than Bitcoin (alongside some reconciliatory comments from Musk), but I am still down overall. I’m also ashamed to say I don’t know exactly what my $100 is worth now because I threw a bit more money in after it went down, as the “degenerate” mindset, unfortunately, rubbed off on me. If this isn’t the equivalent of going back to the ATM after losing all your money at a Casino then I don’t know what is. And the doors never close…

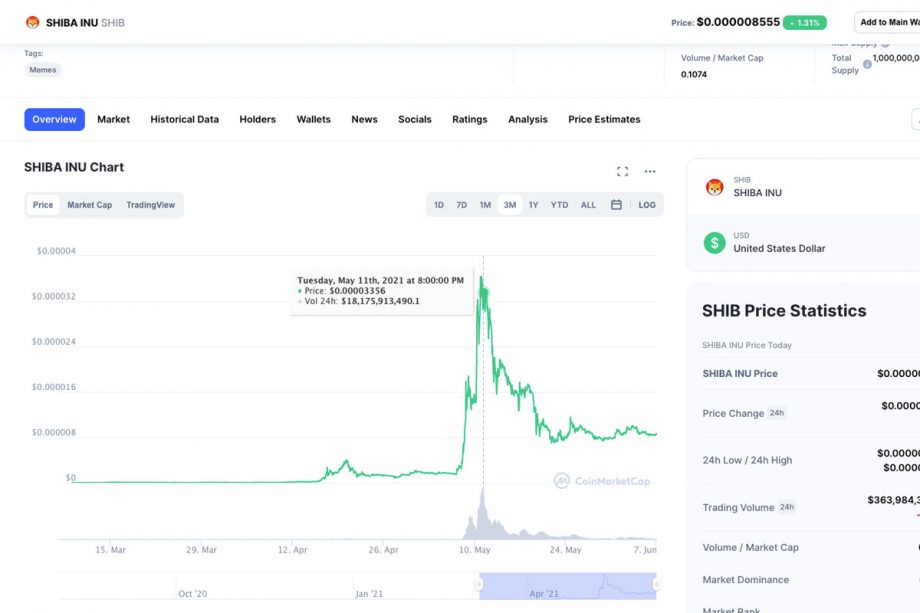

Shiba Inu

I also bought $100 of Shiba Inu at the latest big peak. It has likewise gone down, and I can’t tell you how much it is now worth because I have desperately thrown more bits and pieces (think, $30, $50) at it since the various dips. For those wondering what Shiba Inu is, it hopes to be the next Dogecoin and its anonymous founder (without asking) earlier this year sent 50% of Shiba Inu coins to Russian-Canadian Ethereum co-founder Vitalik Buterin (presumably in an attempt to garner publicity).

Buterin didn’t want the responsibility so burnt much of the wallet and donated the rest to charity. This caused a widespread sell-off. As Buterin said on the Lex Fridman podcast recently, though many users were angry they lost money, many others were glad to have been part of something that did good in the world. My reasoning for buying Shiba Inu was simple: I liked the sound of it maybe being the next Dogecoin (though I have no facts to back this up, and haven’t read any of its White Paper). That prophecy has yet to come true.

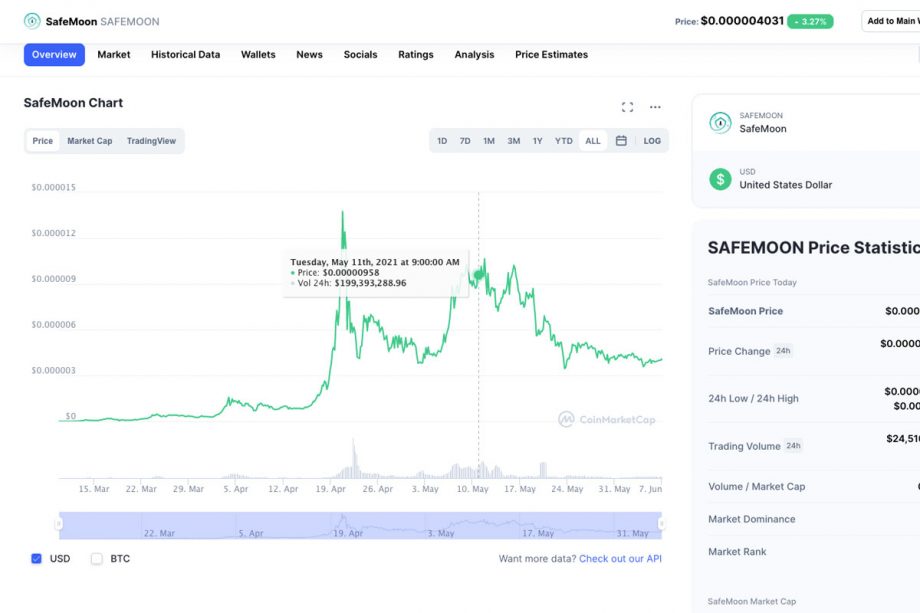

SafeMoon

In true cult-like fashion, the only reason I bought SafeMoon (and the original impetus for this whole experiment) is because one of my housemates is obsessed with it, claiming to have made $2,000 overnight (and then pulling out before the major spike even happened).

On reflection, I doubt it has any real value whatsoever and I suspect its “charity project” in Africa, which came to my attention after I had already bought it, is just hot air to encourage gullible people to join the group. It’s probably just a Ponzi scheme/sh*t coin with a somewhat more sophisticated veneer than many of the others (though I could be wrong).

I also completely fell for the buzzword concept of “tokenomics” in which this coin (like many others) claims to reward long term holders by taxing sellers and redistributing that money among holders. However, after having negative experiences with other coins which mimic SafeMoon’s model (see: Astro Pup) I have learned in any of these things you are utterly at the mercy of the developers.

Though the value of my SafeMoon hasn’t completely bottomed out like some of the other “sh*t coins” I bought, my other bad experiences have rattled my faith. Still, I’m holding out hope for one more big spike before cashing out.

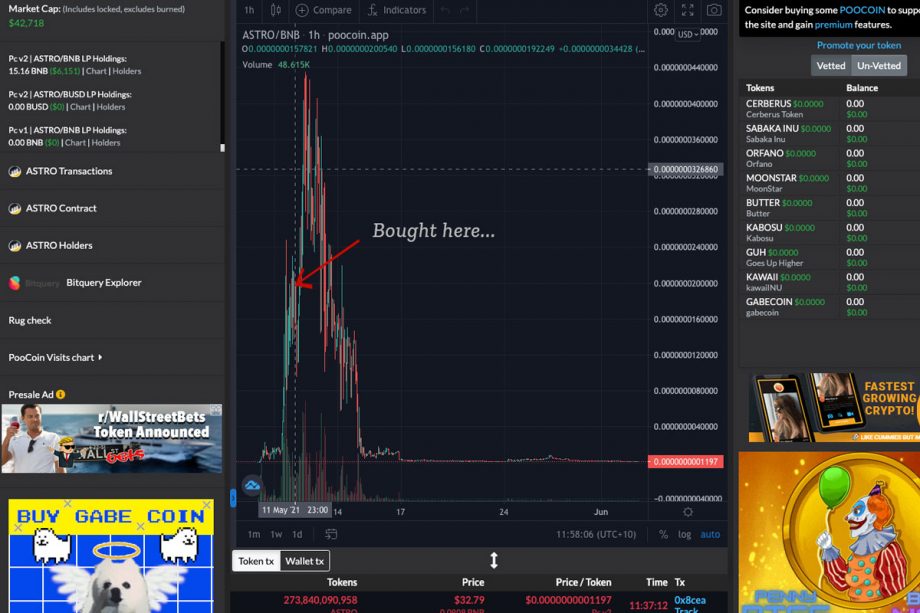

Astro Pup

I’ll be honest: even though I hyped myself up and told myself (“I’m not gambling anything I’m not happy to lose”) this one broke my heart. I scanned through the BscScan token transfer list (a list of all the coins currently being bought and sold), picked a random coin so new it didn’t even have an icon yet (as I was taught in the depths of Reddit), and congratulated myself on getting in early on a sure-fire winner…

I made sure it had a high market cap and that it wasn’t being held by one huge whale holder, and that it had a high turnover of transfers, and put about $50 in. As this coin, like SafeMoon, was quite new, I had to use an application called TrustWallet and then use another app called Pancake Swap to make the purchase. I went to bed that night and woke up to find my money had tripled! Greed and a lack of technological prowess (my housemate did the whole Pancake Palaver for me) meant I decided to wait a little longer before cashing out. Wouldn’t you know: in the time it took for me to decide I should get him to help me cash out the entire value of the coin went basically to zero.

It was claimed on the coin’s Reddit page that one developer went rogue. Then, even in the wake of this scam, another scam – Astro Kitty – was promoted in this group’s ashes. It was also promised – as the price of Astro Pup was about halfway through plummeting – that users’ coins would be automatically re-instated, as part of the ‘good’ developers’ next project, to make up for the massive rug pull that had occurred by the ‘bad’ rogue developer, “Bobo.” This has yet to happen, and I assume it was simply a ploy to stop people from selling off so fast. It’s now pointless for me to sell as the transaction fee involved in selling (about $1.25) is higher than what my $50 is now worth.

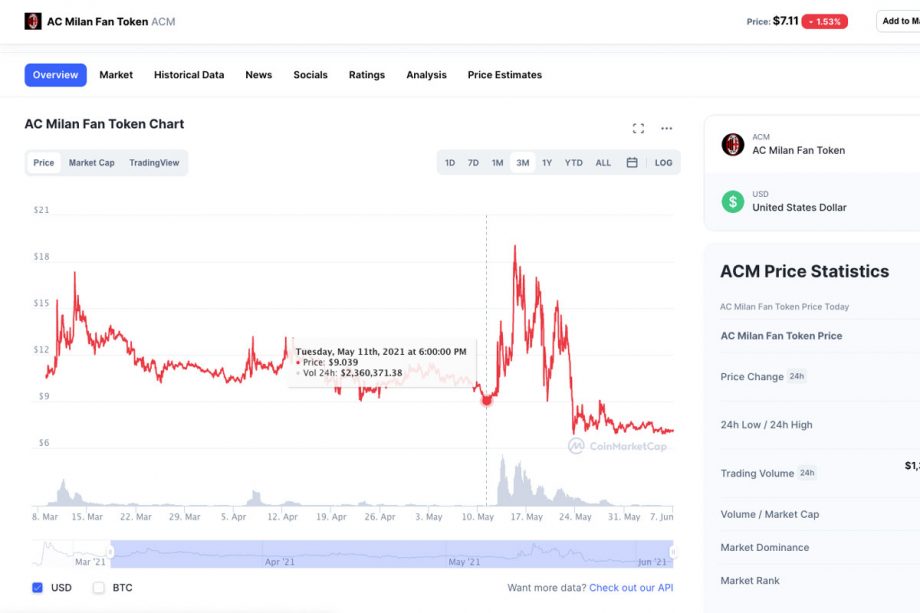

AC Milan Fan Token

I bought $10 of AC Milan Fan Token on May the 11th, for the sheer hell of it. That $10 got up to about $14 at its highest, then started dropping. I sold when it dropped back down to $9. Not my worst loss, but a loss nonetheless.

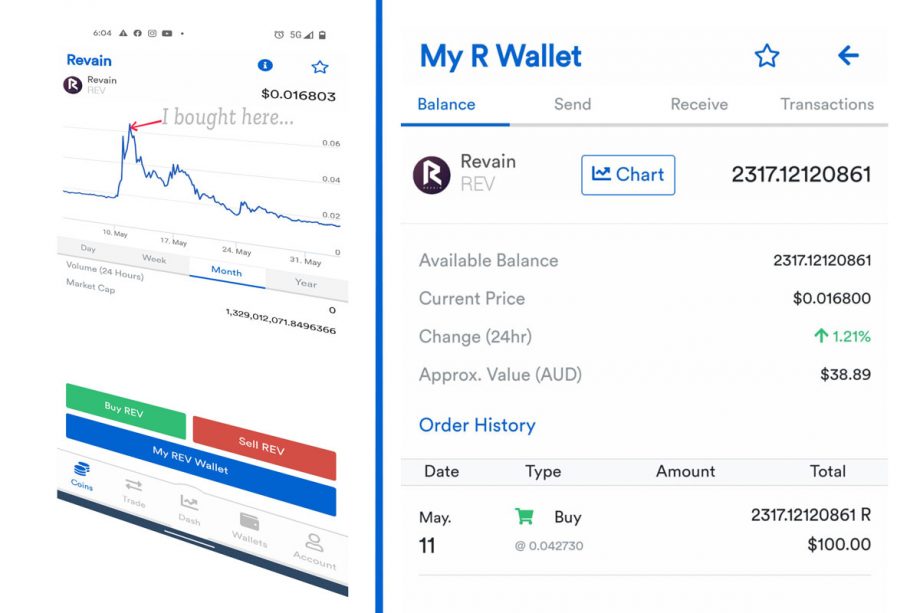

Revain

Like AC Milan Fan Token, Revain taught me never to buy something just because it is a top ‘gainer’ on any given day…

… or at least – don’t think you’re Warren Buffet for doing so. Sure: the price might keep going up for a bit, but it’s most likely not going to last…

I thought I was a genius on day two for making a tidy $3 profit on my $100 Revain investment, before watching it crumble over the next two weeks. My $100 investment is now worth $38.89.

Ethereum

Ethereum tanked along with Bitcoin (and most of the crypto currency world) a couple of days after I put money in. I also put a bit more money in after it crashed in hope of making some of my losses back. It has now recovered a little.

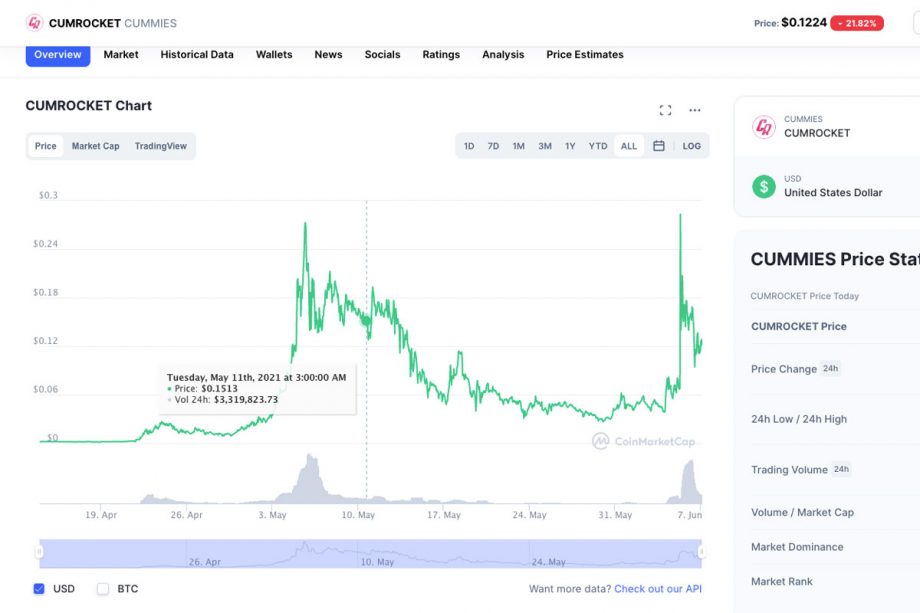

CumRocket

This is the most ridiculous sounding of my gambles. It also came recommended by another housemate. It is yet another “sh*t coin” but one which claims to actually have a use case – CumRocket Crypto claims to present “a revolutionary take on the multi-billion pornography industry, aiming to decentralize it and make it rewarding for both creators and fans.”

It is the only one of my coins that has spiked significantly since I purchased it (due to Elon Musk tweeting about it). I was too greedy to cash out at the time though (as my ‘investment’ of $14 odd dollars spiked to $40) and when it started going down again I decided I had so little in there I may as well write this cycle off and hold out hope for another spike.

I attribute this (minor) win to dumb luck.

Biggest Learnings

Though their use cases are truly dodgy (or proudly non existant), there is a real sense of community in the “sh*t coin” world

Sneer at it all you want, question its motivations, (in most cases rightly) deride the projects as all smoke and mirrors – but wanting to get rich quick really does bring people together. The only problem is, one would expect, as soon as they do get rich quick, it then becomes every user for themself – for most.

That being said, as The New York Times recently discussed on The Daily Podcast, there is a small portion of people who are so disenfranchised with the traditional financial system, and have such faith in these projects, that they are in crypto for the long haul (or give every indication of being). One man, who The New York Times interviewed, made millions out of Dogecoin this year yet still refuses to cash out.

You’d have to assume (I do, anyway) that people like this are in the vast minority.

Don’t cut your losses if you haven’t put that much in anyway…

This is highly subjective… But, in my view, if you put a small amount of money into a speculative “sh*t coin”, with full knowledge that you may lose it all (which, given how volatile crypto is, should always be the case); maybe think twice before pulling it out at the first hint of a dip. Especially given the number of transaction fees and hassle involved with buying and selling and transferring with these little known coins. All you need is one of them to spike one more time to (hopefully) get your money back.

But also… don’t be too greedy

Treat every coin like it’s a scam. If you make money, cash out. Or someone else will first.

Always make sure you have enough BNB to cash out if you need to

I learnt this the hard way… BNB is a cryptocurrency that can be used to trade and pay fees on the Binance cryptocurrency exchange. If all your coins can be bought and traded on CoinSpot (or another similar app) then you don’t need to worry about this. However, if you are buying new or obscure coins on the likes of Trust Wallet (with Pancake Swap), as I did with some of mine, you will need to ensure you have enough BNB to cash out, so you can do so quickly if you need too.

Take notes of how much money you put into each coin at the beginning

When you wake up each morning the plus or minus percentage sign which tells you how each currency is tracking relates to the last 24 hours only – not to when you first bought the coin. This is less important if you invest on the likes of CoinSpot, where you can easily check how much you paid in the first place at any time, but crucial if you are buying super speculative coins (as I did) on TrustWallet, where all you see is the current value of your coin. If you’re buying a lot, like I did, it’s easy to lose track and not even know if you’ve made a profit or loss at any given moment, thus missing opportunities to sell.

Triple check the coin address before buying anything

There are often imitations of popular sh*t coins (scams running off the back of scams) with very similar names and acronyms. If you fall for one of these you are never getting your money back.

Not every new coin is destined to make it from the depths of TrustWallet and Pancake Swap to official exchanges like CoinSpot

When asked, “What metrics does CoinSpot evaluate a crypto currency against when deciding whether to add it (or not) to the Coinspot platform?”, founder and CEO of CoinSpot, Russell Wilson, told DMARGE: “We will always look for projects that have gathered interest from the community and that also meet the requirements of our internal and external due diligence processes.”

Notifications on your phone are a blessing and a curse

They are essential to having any hope of cashing out during a peak, given how volatile the market is, however they will destroy your productivity during the day as they constantly distract you.

They will also stress you out until you come to terms with losing your money, and you will inevitably find yourself on your phone at strange hours of the night and dissecting Elon Musk’s Tweets asking: “What am I doing with my life” and “How have I stooped so low as to become a cult figure worshipping fanboy?”

No one will ever be happy for you

If you lose money people will think you’re an idiot. If you make money no one will want to hear about it.

Searching for ‘winners’ on the BscScan page (or worse: the Reddit Crypto Moon Shoots page) is like panning for fools gold… on a deserted island full of clown heads ready to pop up and smack you in the face

A subjective opinion, but one I stand by…

Tokenomics may be the ‘scammiest’ buzz word of the 21st century

It got me hook, line and sinker, though.

It’s almost like a sport

I see how people get into it: despite the stress, everyone enjoys the dopamine rush of facing a challenge and becoming more competent. Even though there is a huge element of luck involved, and putting money into speculative coins is essentially gambling (arguably worse), there is a certain thrill involved in learning the ropes of something new.

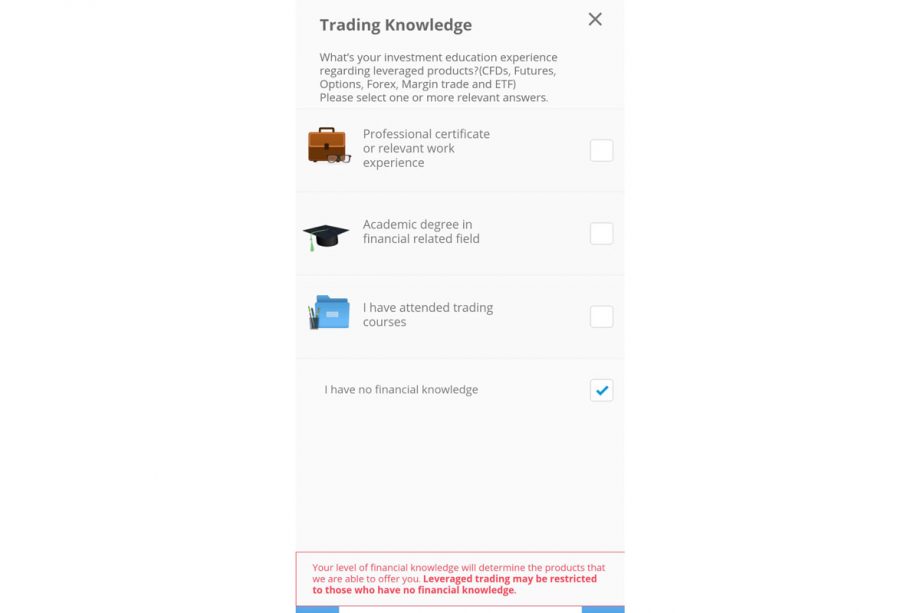

It’s addictive… & can lead you down other risky roads

I now feel much more liable to act on impulse: when the news broke last week that GameStop 2.0 could be happening with AMC (over on the traditional stock market), I downloaded a stock investing app and was on the brink of chucking $500 in (and would have done so) were it not for my failing the financial literacy quiz (and not having my passport number on hand). When I saw it had plummeted by the time I got home I breathed a sigh of relief and decided to take a step back…

I’m still unsure about how I feel about the crypto currency market

I sympathise with elements of feeling like you’re part of something. I also see how people being bored, lonely and greedy can lead to the formation of these online communities. I also enjoyed – and experienced first hand – the thrill of feeling like you are part of some Robin Hood type venture. But deep down I know it’s more of a manipulative cult where everyone is essentially out for themselves, and it’s worrying the degree to which some of these communities prey on people’s vulnerabilities. There is quite the grey area.

On top of that, even though I have lost a lot of money, the few instances where I did make a small profit were thrilling, being someone who has never really gambled much before on the horses or the pokies. The feeling of being rewarded for doing nothing hits harder than a fried chicken vape…

The most thrilling (and low key terrifying) thing about it? This casino never closes. I can only hope I am not now addicted for life.

What the experts have to say

eToro

When asked about the most common mistakes rookie traders make, Josh Gilbert, market analyst at eToro, told DMARGE: “Rookie mistakes are common in any market that aims to empower the everyday investor.” Judging by his list, I fell into many of the common traps – especially the “emotional investing” one.

Some mistakes to avoid, he told DMARGE, include:

- Lack of understanding: Investors should ensure they’ve done their research and understand the asset they’re investing in, before deploying any capital.

- Emotional investing: While the crypto market is one that invokes a lot of passion, it’s important that rookie investors keep their emotions at bay and take a calculated approach when investing. Crypto markets can be volatile, so it’s important to maintain a level head, regardless of whether the market is experiencing a bull or bear run. Neither overconfidence nor FUD (fear, uncertainty, doubt) should motivate your investments.

- Hype-investing: The fear of missing out (FOMO) has led many investors down the road to disaster. Investors might seem tempted to jump into a cryptoasset that’s skyrocketing, but it’s important to understand the function of the asset. I highly recommend reading whitepapers associated with projects before investing.

- Putting your eggs in one basket: Diversification is the aim of the game. Instead of putting all their money into one cryptoasset, investors can hedge against risks by investing in multiple assets, lessening the blow if a coin unexpectedly drops in value. Smart investors instead diversify their crypto portfolios with a range of different assets and products.

Josh also busted a few quick myths about the sector, telling DMARGE this notion that crypto is a get-rich-quick scheme is flawed.

“Yes, investors can make some significant cash from crypto, but all in all, it should not be used as a main income. Like traditional stocks, crypto is very volatile, which means that smart investors should adopt responsible investing principles when dipping their toes into the crypto pool, and only invest what they can afford to lose.”

He also told us it is false that crypto is just for illegal dealings – another common myth.

“This argument stems from the association between crypto and shady operations, such as the now defunct Silk Road or dark-web services. With regulation and mass adoption, crypto has transitioned away from some of its original use cases. To a certain extent, cryptoassets can be used for illicit activities, but no more than traditional fiat currencies (like the US or AU dollar) can.”

Josh also said that contrary to popular belief, crypto is not completely unregulated: “Cryptoassets are legal and treated as an asset class in Australia. This means they’re subject to capital gains tax. Institutional investors and SMSFs are eligible to invest in cryptocurrency as permitted by their fund’s investment strategy.”

Vanguard Australia

When DMARGE sought comment from Vanguard Australia we were provided with the following quote:

“We do urge caution against speculating in Bitcoin and other cryptocurrencies, which are largely unregulated and accompanied by a number of considerable risks including the potential loss of investment entirely in some instances.”

We were also provided with the following segment of the Australian Financial review, in which the AFR interview’s Vanguard Australia’s Balaji Gopal.

“A long-term portfolio should be comprised of stocks, bonds and cash,” Balaji Gopal, head of Vanguard Australia’s Personal Investor platform, told The Australian Financial Review. “We are quite happy to sit this one [cryptocurrency ETF] out, and we urge investors to be very wary of the risks of cryptocurrencies.”

Bitcoin and other cryptocurrencies fall short of Vanguard’s house definition for an asset class, commodity or even currency, Mr Gopal said, because they do not generate income or cash flow. Nor are they a store of wealth, unit of account or medium of exchange, he added, rejecting popular conceptions.

“Cryptocurrencies defy any kind of categorisation,” he said. “Their characteristics are more similar to collectables like fine art, exotic cars or baseball cards.”

Do ‘meme coins’ delegitimize crypto currency as a whole?

DMARGE also asked Josh from eToro about the impact of light-hearted coins on the market.

“The mass adoption of the coin of late,” he said, “demonstrates the potential for crypto to gain real-world mass adoption, rather than delegitimise crypto.”

“It’s likely that Dogecoin is here to stay. As for other memecoins, some will stick, others will come and go. It really depends on the adoption, tokenomics, market capitalisation and the development teams behind them.”

The ideological argument…

We also quizzed Josh about the philosophical motivations behind crypto currency. He told us the following.

“Some people are starting to look beyond their banks and opt to invest in crypto as a way to make their money work for them, instead of gathering dust in their savings accounts.”

“There is a growing population that has become disenfranchised from financial institutions and is looking for trustless solutions to manage their assets. Others have become wary of the impact inflation will have after global economic stimulus packages and are turning to crypto to hedge against it.”

“However, this isn’t the only reason why crypto is booming right now. Thanks to popular assets like Bitcoin, which has rallied over 100 per cent this year alone, as well as hype from ‘technoking’ Elon Musk, the market has doubled since February 2021, as retail and institutional investors pile into the space.”

“Is it also out of FOMO? For some investors, probably. With the built up chatter around cryptoassets, there are definitely Aussies who are new to the space and are making investments for the first time based on what they’re seeing in the news and social media, or hearing from their friends.”

“For those new investors, eToro encourages them to be smart about their investments and do their research and homework. Cryptoassets remain a relatively new asset class, and like other investments, they are volatile. As such, investors should ensure they are diversified and hold a range of assets across their portfolios.”

Does Elon Musk’s influence prove the market is immature?

“It’s probably a mix of both,” Josh told us. “Elon Musk’s influence on markets demonstrates how many investors purchase based on hype, rather than doing their own research. In saying this, the market is still yet to fully mature and will continue to be volatile. The swings and roundabouts, particularly those driven by Musk, demonstrate how impactful communications can drive the uptake and mass adoption of crypto as a viable asset.”

“eToro supports regulatory measures and we hope that any guidance put in place will balance the need to protect investors with a desire to support their participation in the crypto markets.”

“Increased regulation will also help to facilitate greater use of a technology that can not only deliver real benefits to the financial services sector, but also support greater financial inclusion globally.”

The cybersecurity perspective

Aaron Bugal, Global Solutions Engineer and APJ at Sophos, told DMARGE the following:

“There’s always an element of risk involved with investing, but it’s important to decipher between ‘investment risk’ and something that’s just an outright scam. Due to its unregulated nature, the world of crypto trading attracts some dodgy dealers as well as cybercriminals looking to steal your personal data and your money. Its therefore even more important to approach every trade with caution.”

“Firstly, be wary of any online scheme that makes promises a properly regulated investment wouldn’t be allowed to do. These regulations are put in place to stop people making promises they can’t keep, so be sceptical of any promise that sounds too good to be true, as it most likely is.”

“Secondly, don’t let yourself become overwhelmed by crypto-jargon and a sleek looking website or app. Anyone can build a website and fill it with crypto terminology and acronyms. Don’t be fooled into making decisions you don’t understand or don’t trust. Take a step back and look for reasons the ‘investment’ could be a scam, rather than trying to prove it isn’t.”

“You should also seek guidance from people you know and trust, especially if cybersecurity is their area of expertise. They’ll be able to assist in navigating these processes and help you avoid falling for crypto scams.”

“Remember; if it sounds good to be true, it probably is. No one can ever promise they’ll turn a dollar into a million dollars—if that were possible, everyone would have done it already. When the offer is that good, be suspicious. Never let yourself be too emotive or be pressured by ‘act now or miss out’ calls to action.”

Phishing warnings rookie investors need to be aware of

Bugal also gave us the following insights regarding scams:

“There has been a huge increase in fraudulent applications aimed at exploiting the increased interest in trading apps, driven by the recent volatility of cryptocurrencies and interest in low-cost or free stock trading driven by stories like the recent GameStop stock speculation.”

“Sophos recently uncovered hundreds of counterfeit Android and iOS apps disguised as trading and cryptocurrency apps. Cybercriminals are leveraging social engineering through dating sites and social media platforms to gain the trust of inexperienced investors and steal their money and personal data.”

“Scammers do this by first gaining your trust, then directing you to a fake trading website or having you download an app disguised to look like the official trading app of a trusted financial organisation.”

“Some of these fake trading apps and sites will include an interface with trading updates, wallets, funds and cryptocurrency deposit and withdrawal features that appear to function just like their legitimate counterparts. The main difference is that any transaction you make goes into the pockets of the scammer instead.”

“Innocent people tend to put trust in things that are presented by someone they think they know. By impersonating well-known apps, these frauds are more believable. Remember, if something seems too good to be true – promised high returns on investments, or professional-looking dating profiles asking to transfer money or crypto assets – it’s likely a scam.”

“To avoid falling prey to these scams, only download crypto apps directly from trusted sources such as Apple’s App Store or Google Play. Developers of popular apps often have a website, which directs users to the genuine app. Before you click on a link, verify that the website and app are genuine, as scammers can build fake websites, apps and even app stores (complete with user reviews) to trick you into believing their validity. We also advise users to consider installing an antivirus app on their mobile device, such as Sophos Intercept X for Mobile, which help protect their device and data from such threats.”