- Tether, remaining true to its purpose as a successful stablecoin, went through the last flash crash largely unscathed

- Recent controversies suggest that USDT may be immune from external threats, but could also be vulnerable to internal chaos

- USDT’s stability amidst controversy highlights the key factors that can make or break its long term success

Tether (USDT), days after a market-wide flash crash wiped hundreds of billions from the global cryptocurrency market (and that saw leading currencies BTC and ETH experience losses of more than 15%), sits at $1.42 AUD at the time of writing, the equivalent of $1.00 USD.

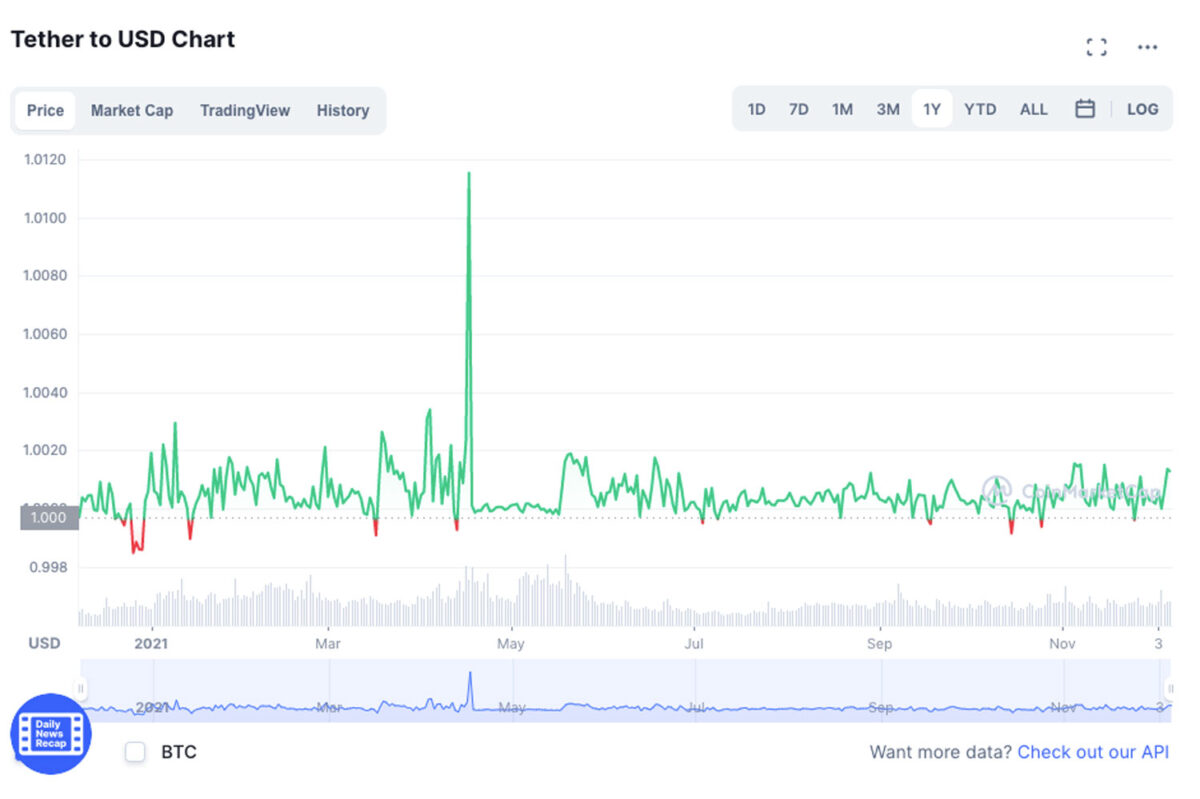

Amidst the widespread volatility, USDT did not fluctuate more than 0.021%, a minuscule price change in comparison to the drastic price slumps encountered by other currencies ranked in the top 10 by largest market cap. Tether’s ability to weather this storm, and remain fixed to $1.00 USD and its vicinity throughout a crypto market downturn, exists entirely by design, with USDT’s essential function as a ‘stablecoin’ being to remain pegged to the US dollar.

Stablecoins generally serve the purpose of providing a means of storing wealth that is unaffected by the conditions of the cryptocurrency market, which are often subject to change without warning. Tether therefore aims to maintain its unrestricted and unimpeded nature as a cryptocurrency whilst incorporating the relative stability of fiat currency.

Provided that Tether is able to maintain its stability, the reliability of which probably underpins the reason its market cap has grown to over $100 billion AUD, USDT’s prominence will likely be based on its widespread usage as a safe haven, as well as its ability to remain immune to the price volatility experienced by most other cryptocurrencies.

In This Tether (USDT) Explainer Story

What Is Tether (USDT)

Originally known as Realcoin, Tether was created in 2014 by founders Brock Pierce, Reeve Collins and Craig Sellars who aimed to provide an antidote to the crypto market’s unpredictability. In the years since its inception, USDT has enabled Tether users to transact with fiat currencies with a simplicity and stability uncharacteristic of typical cryptocurrencies, making otherwise complicated tasks like accounting for digital transactions easier to pin to a consistent currency unit.

At the hands of financial institutions, international transactions involving the exchange of one fiat currency for another can require several days for processing. In contrast, Tether can provide an instantaneous blockchain-based alternative that doesn’t involve any of the typically exorbitant banking fees. This sense of convenience and USDT’s high degree of utility is what has led some large institutions like the Bank of England to consider launching their own stablecoins.

Tether is underpinned by a Hong Kong company named Tether Ltd, which manages Tether’s fiat-collateralization, meaning that they are responsible for ensuring the digital currency is fully backed by real U.S dollar reserves held at banks on a 1:1 basis, as their website asserts. This would mean that, at least in theory, the sum of all Tether tokens is securely and accurately matched by the equivalent total fiat collateral made available, therefore implying an elimination of exchange risk and supposedly guaranteeing seamless redemption of tokens for the underlying fiat value.

Why Is Tether (USDT) Controversial?

Tether’s real US dollar reserve claims have been subject to considerable public scrutiny, with cynics noting that Tether Ltd, despite the company’s claims, have recurrently failed to show proof of the frequent professional audits that it at the time claimed its cash reserves were regularly subjected to. Instances of ambiguity, like the dissolution of its relationship with auditing firm Friedman LLP in 2018, opened the door to questions around whether expansions of Tether’s supply are backed by any substance at all.

What Penalty Did Tether Pay?

These suspicions were at least partly substantiated in October this year when Tether was ordered to pay a penalty of $41 million USD by the Commodity Futures Trading Commision for misrepresenting the sufficiency of its dollar reserves. The CFTC asserts that over a period spanning from June 2016 to February 2019, Tether reserves were, contrary to what it claimed, not “fully backed” the majority of the time, nor were its claims of undergoing routine audit truthful.

Despite the recent controversy, Tether’s continued dominance as the leading stablecoin nonetheless may be perceived to be an indicator that investors’ perception of USDT’s significant utility warrants their continued usage of it.

Why Is Tether Still Successful?

One of the primary reasons for Tether’s continued success is that it arrived as both an early cryptocurrency and as one of the first stablecoins, with USDT’s technologically revolutionary status being complemented by its reputable team of founders.

Since then, Tether’s long-established prominence has survived numerous controversies in addition to the one aforementioned, with notable instances among them being the exposure of a hidden $850 million loss in 2019, a $20,000 Bitcoin pump attributed to Tether, and a recent Bloomberg report that uncovered Tether’s executives use of its reserves to provide loans to large Chinese companies and other crypto companies.

Is Tether A Good Stablecoin?

Arguably, Tether’s ability to ride out such controversies may even be seen as a positive by some users – if it has remained stable through episodes of internal chaos, imagine how good it will be when there aren’t internal issues, the logic goes…

However, the controversies have led some to suggest Tether is more threatened by internal collapse than external market influences, which it was designed to be immune to. Thus it seems the primary risk for users of Tether is its parent company’s potential for internal collapse and track record for recurring error, since the currency itself seems to have largely been successful in making itself immune from the influence of external forces.

Tether (USDT) Price Prediction

According to an algorithm-based prediction from Wallet Investor, natural minor fluctuations will see Tether’s value be at $1.43 AUD (equivalent to $1.004 USD) in 2025, ranging between a low of $1.32 AUD and a high of $1.54 AUD.

Digital Coin Price provides a more stable prediction, estimating that Tether’s value will be $1.43 AUD ($1.01 USD) every year as far as it can foresee.

Whilst not necessarily a threat to its price, the confirmation of plans from governments like the United States and China to create their own digital currencies poses a future threat to Tether’s market share, due to the risk of capital being sucked out from its current market cap sitting at around $100 million AUD.

But if Tether remains in line with its singular aim, even then its price would remain at, or in the vicinity of, $1.00 USD. Periods of unusually high demand, such as when investors flock to it amidst volatile conditions, or low demand like that induced by severely negative headlines, have in the past temporarily caused USDT’s price to rise as high as $1.50 AUD and fall as low as $1.28 AUD, so similar future occurrences are certainly possible.

Tether Limited could also, as it has in past situations, adjust Tether’s supply to recalibrate its price to its usual level. It is important to acknowledge that despite its past reliability, there are no laws that guarantee USDT token’s redemption of the equivalent of its $1.42 AUD ($1.00 USD) benchmark in fiat under any circumstances.

What Will Happen To Tether Over The Next Five Years?

For most cryptocurrencies, threats to their future success are dependent on competition and broader market forces. However, the important question for Tether’s potential success in the long term seems like it will be whether or not those responsible for maintaining USDT’s internal integrity will stay out of its way. Banks introducing their own stablecoins could provide Tether with competition, too, if that happens on a broad scale.

Read Next