Ah, the endless emotional rollercoaster that is the Australian property market. While much discussion of late has been around how tricky the situation is for prospective renters and first-time buyers while homeowners sit easy at the top of the pile, news that prime real estate values are falling in unexpected areas could mark a change of tone…

Last month, DMARGE reported that in Sydney, homes were impossible to buy and were regularly selling at a loss. Now, it seems that this situation could be spreading across Australia, with other cosmopolitan centres recognising similar pricing patterns emerging in their local property markets.

The Australian real estate market represents an endlessly shifting landscape, the latest iteration of which shows property prices cooling off across the board. The result? Those oh-so-trendy inner-city suburbs have become a modicum more affordable.

Perhaps the headline figures from a fascinating set of data are that Sydney’s Cremorne has seen a 23% decrease in median house prices in a year to $2.52 million, while in Melbourne Toorak’s median house price has dropped a substantial 17% to $4,737,500, according to data from Domain.

WATCH: It’s not just a tough time for homeowners – check out how bad the rental market is right now below.

Obviously, these are still eye-watering prices in the eyes of many Aussies, but it marks an interesting turn of events that seems to no longer be localised to NSW’s biggest city. Nevertheless, let’s take a closer look at Sydney before tracking this change elsewhere…

A number of suburbs located within a five-kilometre radius of the Sydney CBD have become more affordable in 2023. The most significant drops in prices were spotted in Cremorne and Cammeray, where house prices have fallen by 23% and 16% respectively.

However, it’s not just the high-end suburbs that have seen a change. Camperdown has experienced a 14% drop to a median price of $1,655,000, while Redfern has seen an 11.3% decrease to a median of $1.65 million. Similarly, the median price of Erskineville homes has come down to $1.58 million.

While the top end of the market is still performing well, Hayden Richards of Ray White notes that it’s the $1 million to $1.8 million price bracket that is struggling: “It’s not as hot as it was last year, but in terms of buyers, there’s still a lot of confidence.”

Now to Melbourne, now officially Australia’s largest city: while Toorak and South Yarra are experiencing the largest inner-city price falls, Melbourne’s inner north has also seen a decline. Homes in Carlton, Carlton North, Fitzroy and Fitzroy North are all more affordable this year, with a 3% decrease in prices.

Despite the reduction in property prices, however, buyers remain cautious in the current economic climate, as Nelson Alexander’s Rick Daniel confirms:

“There is a fair bit of apprehension among buyers who are motivated but don’t want to feel like they’re paying more than they should.”

Rick Daniel of Nelson Alexander

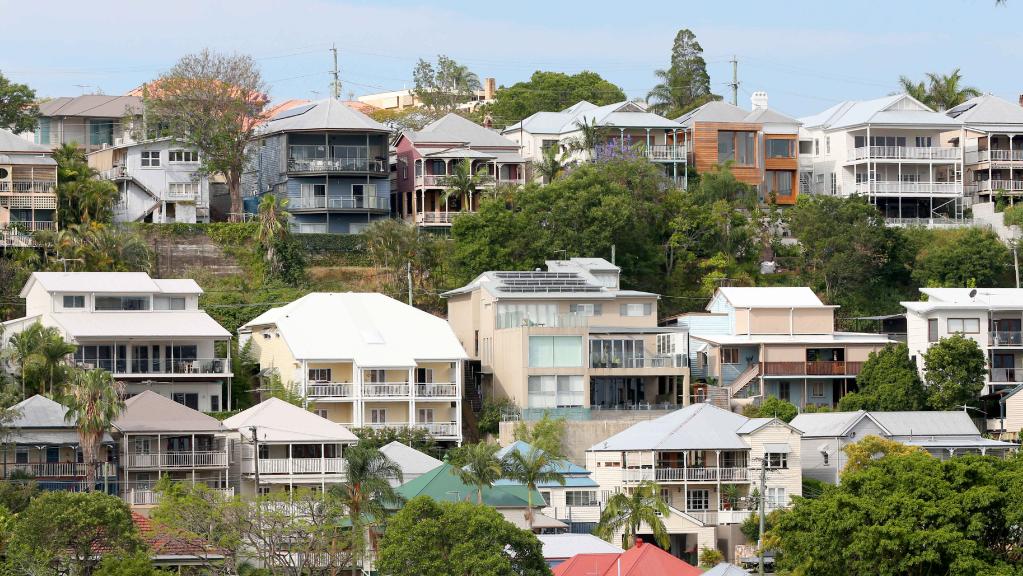

While the property markets in Sydney and Melbourne have taken a hit over the past year, Brisbane’s inner city has managed to hold its ground: inner-city suburbs such as Spring Hill, Hawthorne, and East Brisbane have seen their median house prices drop, but remain relatively affordable compared to their Sydney and Melbourne counterparts.

However, this could in large part be a relative shortage of houses compared to other cities, rather than a stronger housing market per se. Supporting this theory is the struggling apartment market in the city: while apartments did not experience the same boom as houses in the last three years, they are now much more affordable.

With higher demand fuelled by the housing crisis, with well-monied parents opting to buy apartments for their offspring who can’t find a decent place to rent, agents have seen a paradigm shift:

“Five years ago, we had an oversupply of apartments, now we have an undersupply… Young owner-occupiers cannot afford to buy a house within five kilometres of the city. If your budget is $400,000 to $800,000, units represent good value.”

Patrick McKinnon of Place Ascot

The pattern continues in Australia’s other major economic centres: Unley, located just outside Adelaide’s CBD, has seen a 4.4 per cent drop in house prices compared to a year ago. Despite this, the median house price is still sitting at an impressive $1.1 million. Similarly, in North Adelaide, the median price of units has fallen by 7.5 per cent to $462,500.

Moving over to Perth, units in Como, as well as apartments in Mount Lawley and Victoria Park, are all trading for substantially less than they were last year. Even West Perth, a suburb that has traditionally been a hotspot for investors, has seen a minor dip with the median house price now sitting at $471,000.

Once again, it seems that the Bank of Mum and Dad constitutes the fine line separating us all from total market chaos. God bless the Boomers and their endless willingness to support their sprogs, but does that represent a long-term solution to keeping the market steady? We think probably not…