Financial anxiety is (unfortunately) a growing issue in Australia today – particularly when it comes to men.

According to a recent survey published on April 29, the Cost of Living has soared to the top of Australia’s “worry list,” with 50% of all Aussies reporting that increased financial pressure is now their number one concern.

Obviously, money-related hardship can affect anyone regardless of their gender, but here at DMARGE we hone in on the things that disproportionately impact men.

And what a scary number of people don’t seem to know, is that as many as 1 in 5 – roughly 20% – of all male suicides are directly linked to financial stress, according to recent data from the Australian Men’s Health Forum.

Not only that, but male suicide is also 5 times more likely to be linked to financial concerns than female suicide and it’s an unfortunately well-documented fact that rates of male depression and suicide increase significantly during economic downturns.

As we stare down the barrel of an increasingly likely recession in the next year, it’s super important that we try to get a handle on men’s financial wellbeing before it’s simply too late.

Why Does Financial Anxiety Disproportionately Affect Men?

While money concerns affect everyone negatively – a recent study showed that anyone who has recently experienced severe financial strain is 20 times likely to attempt self harm – there’s a major psychological factor that makes financial stress particularly troublesome for men.

Speaking to Health, Dr. Sabrina Romanoff a Professor of Clinical Psychology at Yeshiva University, pointed out that with the role of men traditionally being the breadwinners of the family, it’s quite logical that financial stress would be felt more intensely by guys.

“Financial stress is a significant risk factor for suicide, particularly among people who are tasked with the role of ‘provider’ or those who are responsible for preserving the livelihoods of those who depend upon them.”

Dr. Romanoff

It’s my own personal experience that here in Australia we do very little in the way of any meaningful financial education. Unless you come from a family that talks about money openly or goes out of their way to demonstrate good spending habits, it’s just assumed that you’ll figure it out as you go along.

The “she’ll be right” mentality strikes again.

So, if roughly 20% of all Australian blokes that take their own lives are doing so because of links to financial stress, why aren’t any of our major banks doing something about it?

What Are Men’s Biggest Money Problems?

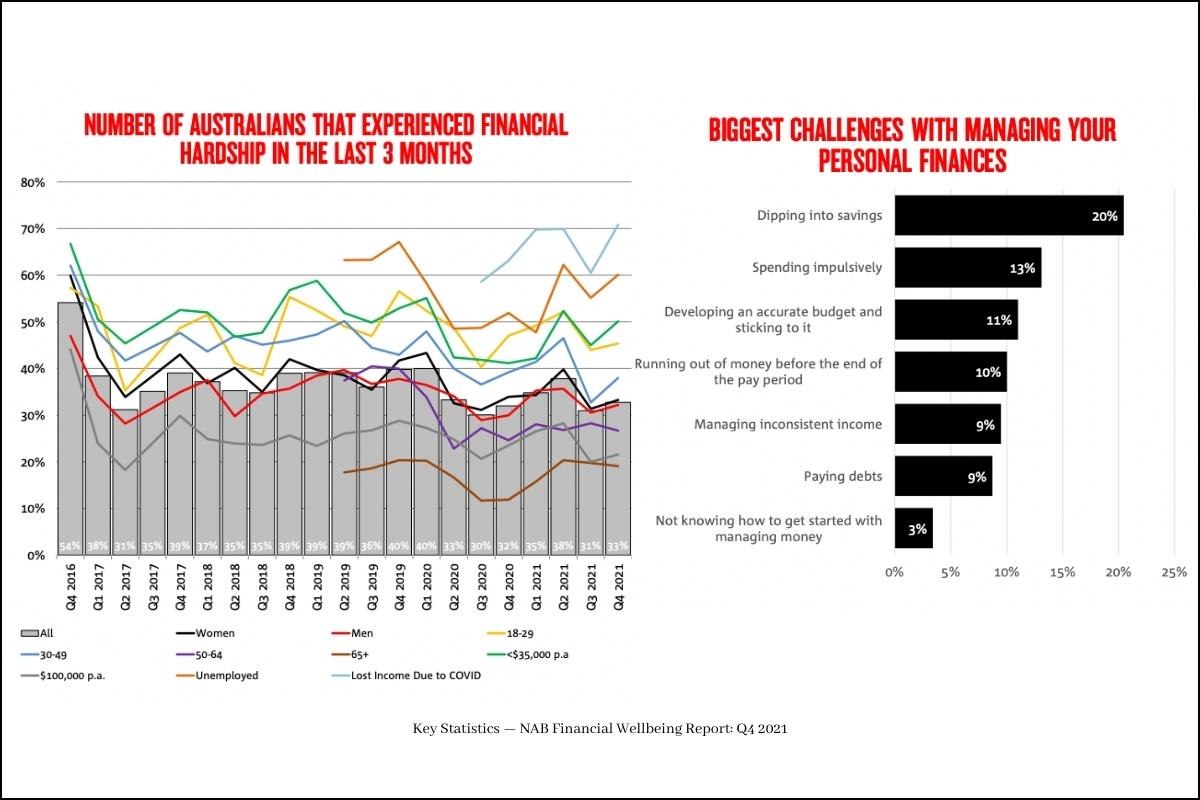

According to NAB’s Australian Financial Wellbeing survey, the most challenging issues that Australian men struggled with were: unexpectedly dipping into savings, followed closely by impulse spending. Notably, outstanding Buy Now Pay Later debts was also a significant male-skewed problem, represented particularly by guys under 35.

While it’s all fun and games to laugh off the occasional blowout on a bunch of beers (and a few extra things) on a big night out, uncontrolled impulse spending can be a serious concern — especially for younger blokes.

Speaking from my own experience as a 25-year-old guy, we always like to put on a brave face and make it seem like we’ve got everything under control, even when things are going terribly just beneath the surface. Admitting that your spending habits aren’t what they should be can be really difficult, because it feels like you’re not living up to your own, or other people’s expectations.

So, I think that it’s time for the link between money and men’s mental health to get some serious air time. Our banks need to step up and start promoting awareness and providing some better education around finances.

We need to change the culture so that men no longer feel “inadequate” for not being the best at managing their money, and start providing some real tools to help them to get better at it.

Men Need Better Education and More Support

Now, I’m not trying to say that the Big Four banks aren’t doing anything at all – I’m simply making the case that a lot more needs to be done if we’re going to take this issue seriously.

While the Big Four Banks do have some resources dedicated to financial wellbeing (Commbank, NAB, ANZ, Westpac) it’s obviously not doing enough.

I’m not taking away from their efforts, but it seems pretty clear to me that our biggest banks and major financial institutions seriously aren’t taking into account the degree to which some basic financial literacy could change the lives of everyday Aussie blokes.

Educating men on how to better manage their finances isn’t just a feel-good marketing pitch, it’s a public health priority.

When nearly 1 in 5 men take their own lives because of financial stress, increased awareness and education can legitimately save lives, especially as we look primed to head into another recession.

Ultimately, any bank or institution that steps up to help tackle these issues would be taking an enormous step forward for the entire industry of finance.

If you are experiencing financial stress, try to remember that literally anyone can get into financial difficulty and that there are so many ways to get help. MensLine have a great list of resources for dealing with acute financial stress.

Quick & Easy Finance Resources

While we wait for the major financial institutions to read this article and start introducing proper financial education tools — I’d recommend taking a quick glance at the following resources:

- The Barefoot Investor: Focused on Australians — super simple and easy to read.

- I Will Teach You To Be Rich: US-focused but packed with heaps of good, simple tips.

- How to Save a Lot of Money Fast: 4 simple methods I’ve personally used to take control of my finances.

Read Next