- Stablecoins are digital assets that fix their price to the value of other financial assets like the US Dollar.

- Because most cryptocurrencies, such as Bitcoin and Ethereum are extremely volatile, stablecoins allow investors to “cash out” and safely store money inside their digital wallets.

- Stablecoins have come under increasing scrutiny from regulators, as the $130 billion ($181 billion AUD) market for stablecoins remains mostly unchecked.

- Some stablecoins are much more “stable” than others and should be approached with caution by crypto investors.

Table of contents

What are stablecoins?

Stablecoins are digital currencies that fix their price 1:1 to an underlying financial asset. The most popular stablecoins are fixed to the US Dollar. Stablecoins rose to prominence as a convenient and ‘stable’ place for investors to store their cash in a market that is notoriously volatile and trades 24/7. Before stablecoins were introduced, investors had to go through a lengthy and expensive process of exchanging their digital assets into fiat currency every time they traded crypto.

How do stablecoins work?

When it comes to stablecoins that track the value of the US Dollar, there are 3 main types that investors need to know about:

- Custodial Stablecoins: are backed 1:1 by a single company. For every 1 USD stablecoin that enters the crypto market, a financial organisation holds the equivalent in dollars. This is the most common type of stablecoin.

Custodial stablecoins include: Tether, USD Coin and Binance USD. - Algorithmic Stablecoins: use a range of blockchain-based mechanisms to maintain their fixed price. After recent regulation fears, algorithmic stablecoins have grown in popularity as they tend to be more structurally decentralised. TerraUSD is an example of an algorithmic stablecoin.

- Collateralised Stablecoins: use smart contracts to “lock up” other crypto assets as collateral for loans. From these loans, automated programs generate new stablecoins accordingly and maintain price stability to the underlying asset. Dai is an example of a collateralised stablecoin.

Which is the safest stablecoin?

Not all stablecoins are made equal. Generally speaking, the best stablecoins for investors are available on a wide range of exchanges and are backed by secure assets. With the number of new stablecoins being introduced, it is essential to have a good understanding of which stablecoins are the most cost-effective and investor friendly.

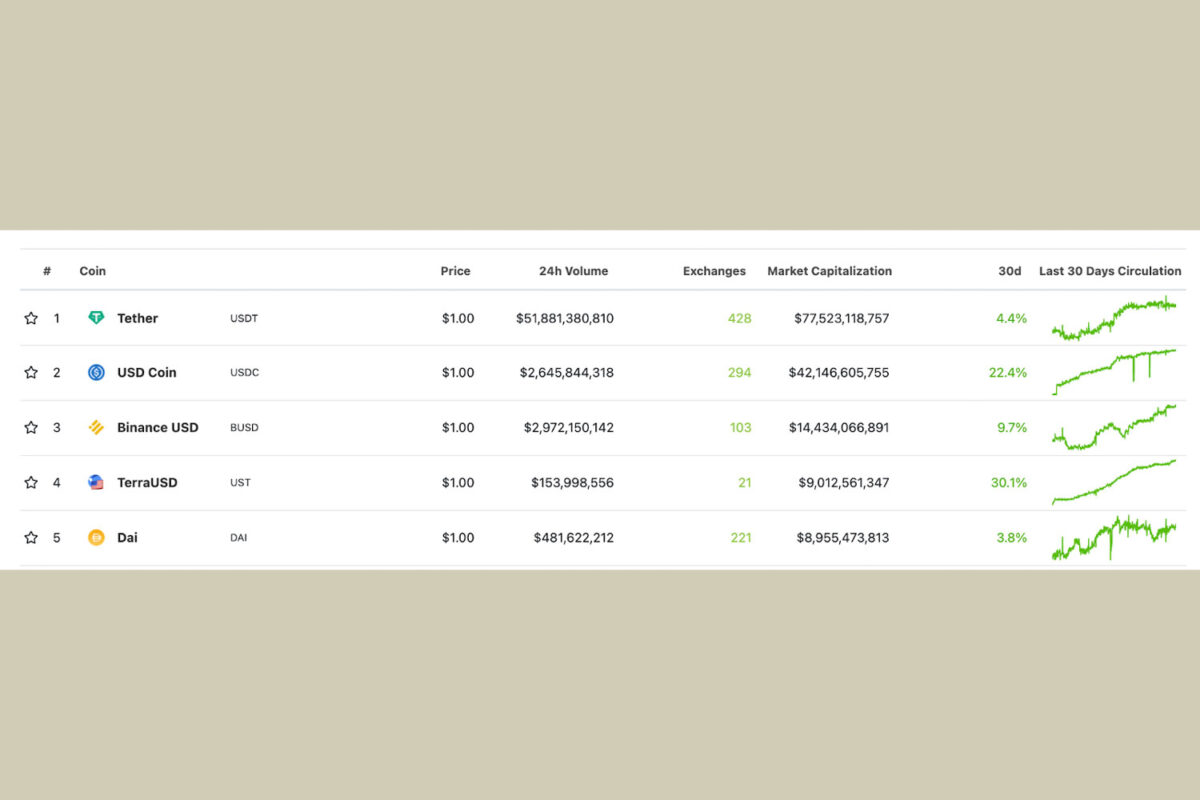

Here are the best stablecoins available right now:

1) Tether (USDT)

Tether, originally launched as RealCoin in 2014 was the first ever stablecoin. Tether is the largest and most well known stablecoin in the crypto market, with a total market cap of $77.5 billion USD ($107.9 billion AUD).

Tether is available on 428 exchanges, making it the most widely-available stablecoin for investors to use.

Despite its superior functionality and market-leader status, Tether has come under increasing legal scrutiny after repeatedly refusing audits and being found guilty of criminal activity. Tether was fined $41 million USD ($57 million AUD) and banned from practice in New York. While these findings have had no impact on Tether’s day-to-day functionality in the crypto market, investors may want to approach Tether with some degree of caution, especially if they are holding large amounts in USDT.

2) USD Coin (USDC)

USD Coin was introduced in 2018 by Coinbase, the world’s first publicly-listed crypto exchange. USDC is currently the 2nd largest stablecoin by market cap, valued at $42.1 billion USD ($58.7 billion AUD).

USDC is available on 294 exchanges, and is working alongside financial institutions and regulators to become a safer, more widely available stablecoin for investors.

Unlike Tether, USDC publishes monthly audits into the status of their reserves.

3) Binance USD (BUSD)

BUSD was launched in 2019 by the world’s largest crypto exchange Binance. BUSD is currently the #3 stablecoin with a market cap of $14.3 billion USD ($20 billion AUD). Only available on 103 exchanges, BUSD is less accessible than its competitors. In place of this BUSD offers unique functionality for investors on its native exchange: Binance.

Users of BUSD get access to zero-fee trading and conversion on Binance and can deposit their stablecoins into lending services that yield up to 15% annually. Investors can also rest assured when it comes to safety, as BUSD publishes monthly audits and is one of only three stablecoins approved by Wall Street regulators.

4) Terra USD (UST)

UST is the most recently introduced and rapidly growing algorithmic stablecoin. Launched in September 2020 on the LUNA blockchain, UST is currently the 4th largest stablecoin by market cap, valued at $9.2 billion USD ($12,971,418,375 AUD). UST is available on just 21 exchanges.

UST makes up for this by offering investors the most secure lending product in the stablecoin market, where investors can deposit their UST into a yield account that uses Terra’s Anchor Protocol to generate 20% annual interest. UST has grown massively in popularity among crypto investors because it is one of few genuinely decentralised stablecoins. Instead of using a custodial model like Tether, the supply of UST algorithmically changes based on information received from Terra’s native LUNA blockchain.

5) Dai (DAI)

DAI is the most popular collateralised stablecoin and the 5th largest overall by market cap, currently valued at $9 billion USD ($12.7 billion AUD). DAI is widely available and can be accessed on 221 different exchanges.

Structurally, DAI is far more technical than other stablecoins. Instead of being backed directly by U.S. dollars like USDT, DAI uses smart contracts to lock up crypto assets like ETH, and generate tokens based on that collateral. It is a product of the Maker Protocol, a decentralised application that runs on the Ethereum blockchain.

Are stablecoins a good investment?

Not really. Investing in a stablecoin may be a good idea if you want to get involved with crypto, but can’t handle its inherent volatility. However, they are called stablecoins for a reason – they don’t tend to fluctuate much in price, up or down.

You can earn interest on your stablecoins by holding them for a long time, but – according to The Motley Fool, “this strategy is essentially a riskier version of putting money in a savings account.”

All up, you’re probably better off putting your money into a diversified (traditional) portfolio, or a legitimate crypto ETF, if you believe the crypto sector has legs.

Do you pay taxes on stablecoins?

In short: yes. According to Crypto Tax Calculator, an Australian Crypto Tax company whose founders DMARGE has interviewed on various occasions: “If you receive a stablecoin as income, you will have to pay income tax on the stablecoin according to your income bracket. In addition, you will have to pay CGT upon your disposal of the stablecoin if you make a capital gain.”

“Despite the value relationship between these cryptocurrencies and fiat currencies, for taxation purposes, they are considered by the ATO to be the same as any other cryptocurrency.”

RELATED: ‘Costly’ Tax Mistake Catching Australian Crypto Investors Unaware

Potential risks with stablecoins

Owing to their fixed price, stablecoins are widely considered to be the “safest” assets in crypto. However, investors should know that unlike other cryptocurrencies, which are structurally decentralised, stablecoins are usually very centralised. Tether, USDC and Binance USD are all owned and operated by single parent companies.

The financial organisations that issue stablecoins amass power and wealth in a similar way to banks but do so without any of the usual licenses or audit requirements. In a few short years, the total value of stablecoins has grown to nearly $130 billion USD ($181 billion AUD). This has led to calls for stablecoins to be regulated like banks, since their activity now meshes them deeply into the financial system, making it easier for economic shocks from either side to reach the other.

Read Next