Sydney rent prices have become a running joke in Australia. The market has boomed to the point where hoarder houses and dishevelled blocks are now selling for eye-watering sums of money. The issue has become a flashpoint for generational and political tensions, and aspiring homeowners are sick of hearing: “If you didn’t eat so much avocado toast you would be able to afford one.”

Sound familiar? A recent experiment conducted by DMARGE using realestate.com.au’s Borrowing Power Calculator has just confirmed that no matter how much we cut down on our avocado splurging, the average Sydneysider is going to have to make a whole lot of lifestyle changes before buying even half the average house.

Interest piqued? Check out our journey with the Borrowing Power Calculator below.

The first step is to answer the question “where are you in your property buying journey.” Your options are: “I’ve just bought,” “I’m ready to make offers,” “I’m searching and inspecting” and “I’m just browsing.”

For the sake of the experiment we hit: “searching and inspecting” and move on. Next question: “will you live in the property when you buy it?”. We answer: “yes.”

Finally, after nailing down the details (state: NSW, city: Sydney, are you a first home buyer: yes) we get to the following section:

“How many people will be buying this property?”

“How many dependents do you have in total?”

Our answers? “Just me”; “zero.”

Next question? Total funds available for the deposit.

Given the ABC recently reported that the median house price in Sydney is $1,309,195, we put

$130, 919 ($1,309,195 divided by 10) as our answer.

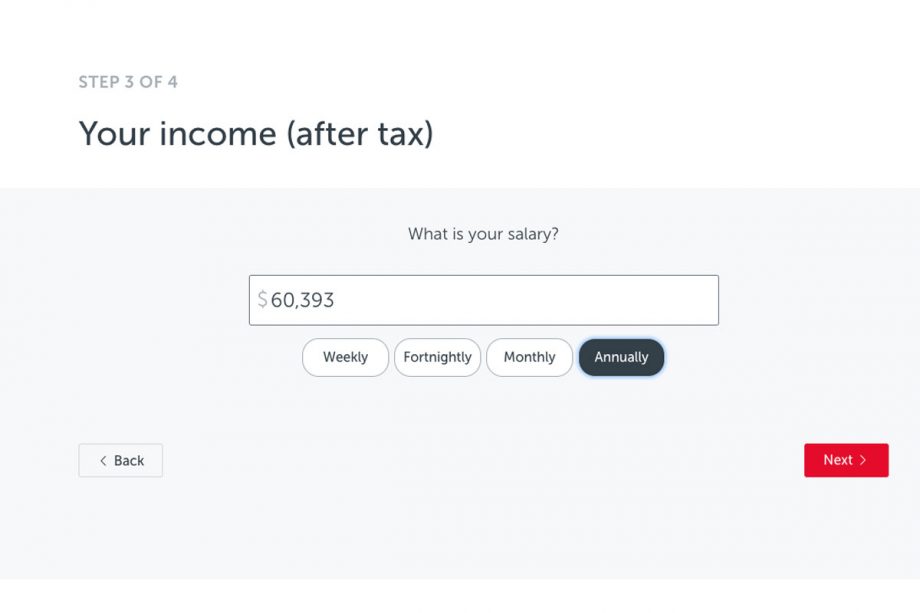

Next question: what is your salary? Here we enter the average salary of a Sydneysider (according to Payscale): 76k, minus tax, which equates to $60,393.

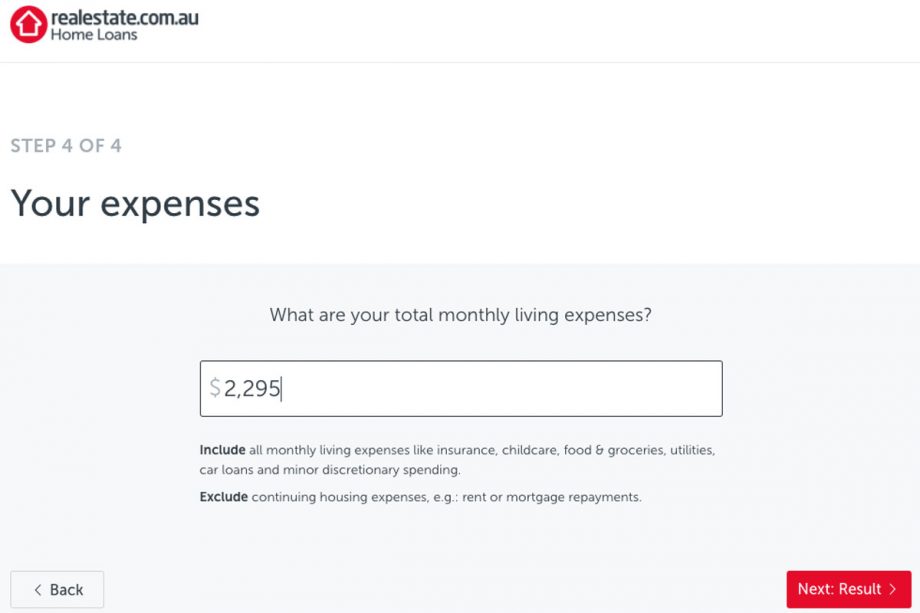

Then, provided you have no additional income or credit cards to declare, you get to the following stage: “do you know your monthly expenses (minus rent)?”

According to homeloanexperts.com, the average living cost in Australia for one person is $2,835 per month including rent. The average rent in Sydney is $540 for houses (according to a Domain rental report from December 2020). We minus the $540 from the $2,835, and enter $2,295 into the calculator.

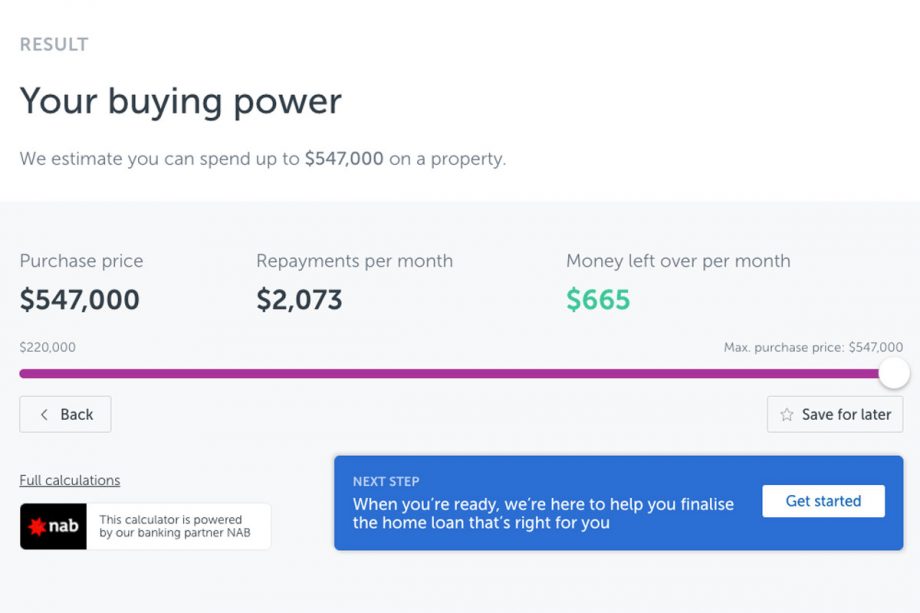

Then comes the moment of truth: the result.

It’s official: the average Sydneysider in Sydney has the buying power (if they already have a 130k deposit saved up) to buy… half the average house! In fact, with the average house price in Sydney being $1,309,195, with a buying power of $547,000, you’re actually 215,195 short of being able to purchase half of the average house…

Solutions? Get a better-paid job. Find a partner to buy a house with. Buy a house in a less desirable area. Buy a unit. Become a digital nomad and move to Noosa. Hope the bubble pops. That’s the glib take.

To go beyond running our mouths, we spoke to Brodie Haupt – millennial, property guru, and CEO/co-founder of Australian digital lending and payments provider WLTH, to get his thoughts.

“There are a number of signs to look out for when talking to clients that would suggest that they are over-leveraged, starting with personal debt,” Haupt told DMARGE.

“We are seeing personal loans and credit cards with high limits or multiple accounts, and we are also seeing more payday loans, sometimes even multiple accounts. If potential customers are extending themselves before they apply for a loan, it makes it difficult to see how they will be able to service a home loan at current rates. The main issue with this is that rates are currently at all-time lows, so lenders need to take into account what an increase in interest rates would mean.”

“For anyone applying for a home loan, there needs to be a comfortable buffer in place, just in case the interest rates shift,” Haupt added, when we asked for his take on what counts as being over-leveraged in today’s market, which we all believe is overhyped – but which some believe may be propped up forever by the government.

“It is expected that rates will shift, but we would expect that this would be over a number of years, with small incremental increases to ensure that Australians would be able to slowly adapt to change. A 1 per cent change in rates would potentially put the majority of Australians with a loan under a huge amount of pressure.”

“We have seen over the last few months, as house prices continue to rise, more Australians are trying to increase their borrowing capacity to be able to get into the property market. This can create a number of issues down the line, especially if people are overextending themselves in order to buy the home they want, while rates are low,” Haupt explained.

“If they are overextended at current rates if there is a shift in the near future, how will they be able to service the loan on an ongoing basis? This increases household debt and stress, which can negatively impact Australians.”

On the topic of locking interest rates in (or not) Haupt told DMARGE: “In some scenarios, fixed rates can make sense, especially in regards to fixing a percentage of your overall loan.”

“One of the issues with fixing your loan is removing the flexibility, so although the rates might look attractive, it might end up costing you much more in the long run. For whatever reason, your financial situation might change and you might be able to pay off a large portion of your loan or you might want to pay off larger instalments if you got a pay rise so you can pay down your loan faster, but a fixed loan can impact your ability to do so and end up costing you more money in the long run in fees.”

“Before choosing a fixed rate, it’s a good idea to make sure that you are aware of all the fees and do your research so that you understand all the information at hand. This will help protect you from unexpected costs that may pop up.”

“The difference between buying an $800,000 unit vs a $2 million house for a couple will all depend on income, savings, investments, and current financial position. It is important to look at how comfortably you are able to make repayments. If you are looking to work out if you are over-leveraged, do your calculations and ensure that you can comfortably live after making your repayments.”

“This includes being able to save money, as well as having an emergency fund for unexpected expenses, such as medical bills and damages to your home and motor vehicles, that always seem to occur when you least expect it.”

There’s your Sunday dose of realism, served hot.