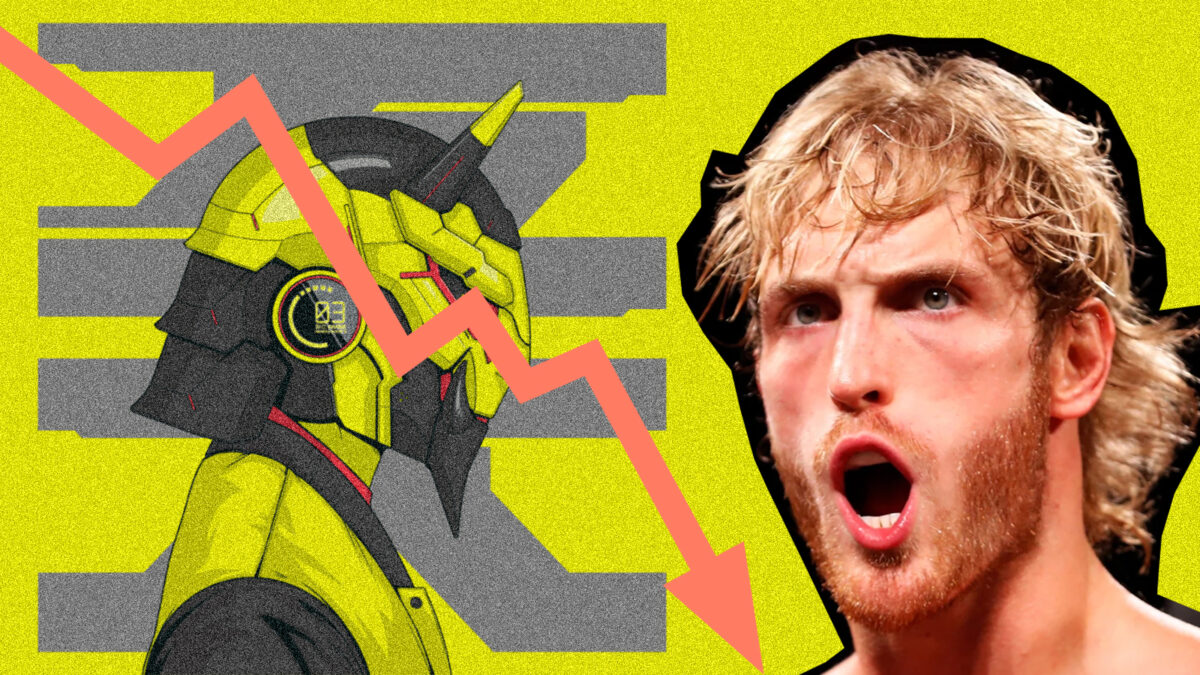

Logan Paul, the controversial social media personality / professional wrestler / noted NFT fanboy, has confirmed that he’s lost a truly enormous amount of money on his NFT investments, with the 27-year-old singling out that the price of one of his favourite NFTs has fallen to “essentially nothing”.

The NFT in question is K4M-1 #03 from the 0N1 Force collection, a collection of anime-inspired avatars. Paul reportedly bought the NFT in August 2021 for the eye-watering sum of US$623,000 – but now it’s only worth around $10 (although some are offering Paul around $2,900 for it).

That’s only the tip of the iceberg when it comes to Paul’s NFT losses, however. In December 2021, Paul confirmed that he has spent close to US$2.7m on his NFT collection but according to Yahoo Finance, Paul’s entire NFT portfolio is now worth around $889,000 – a loss of around $1.8m.

Despite this, Paul is continuing his hard-core boosterism of NFTs, even using the loss he’s incurred on this 0N1 Force number as the inspiration for yet another NFT in his own collection of NFTs, called 99 Originals (which itself has seen its value tank in recent months). Very meta… And if I keep having to type ‘NFT’, I’m going to do my head in.

A year ago, I spent $623,000 on an NFT. Today, it’s worth essentially nothing.

— Logan Paul (@LoganPaul) July 13, 2022

I’ve immortalized this mistake in 99 Originals with an exact replica helmet & outfithttps://t.co/OzBRdQPxUK pic.twitter.com/srD2h4SgO7

Logan has made his love of alternative asset classes a huge part of his public persona. He notably made headlines earlier this year after he secured the Guinness World Record for the Most Expensive Pokémon Trading Card Sold at a Private Sale, after buying a 1/1 PSA 10 Pikachu Illustrator card for US$5,275,000.

Ironically, Paul actually put that Pokémon card up for auction earlier this month, with it going at auction for ‘only’ $480,000 (which includes a buyer’s premium of $80,000) – representing an over 92% loss for Paul. Guess it’s not just his NFTs that are tanking…

Why are NFTs crashing?

As Curzio Research explains, “prices for all risky assets are under pressure as the Federal Reserve raises interest rates.”

“Higher interest rates make safe investments (like short-term bonds) more attractive to investors. The result is that money is getting sucked out of riskier stuff (like stocks, cryptocurrencies, and NFTs).”

Read Next