We’d all like Endless Money. But other than a few rare exceptions – this man who found an ATM glitch and used it to withdraw $1.6 million (and hire a private jet) springs to mind – most of us have to work for a living.

But what if we told you there was a way to get free money?

As we recently read on investing news and advice website Motley Fool, “If an investor put $10,000 into the ASX share market and it returned 10% per annum over the next two decades then it would turn into just over $73,000 over the next two decades.”

Not bad.

It gets better though.

“If that same investor put in the $10,000 at the start and then invested $200 every month for the next 20 years, with the ASX share market making returns of 10% per annum, then it turns into $225,000 over 20 years,” Motley Investor says.

“If the investor put in $1,000 a month instead of $200 a month then they’d have $832,650 after that 20 year period.”

The joys of compound interest.

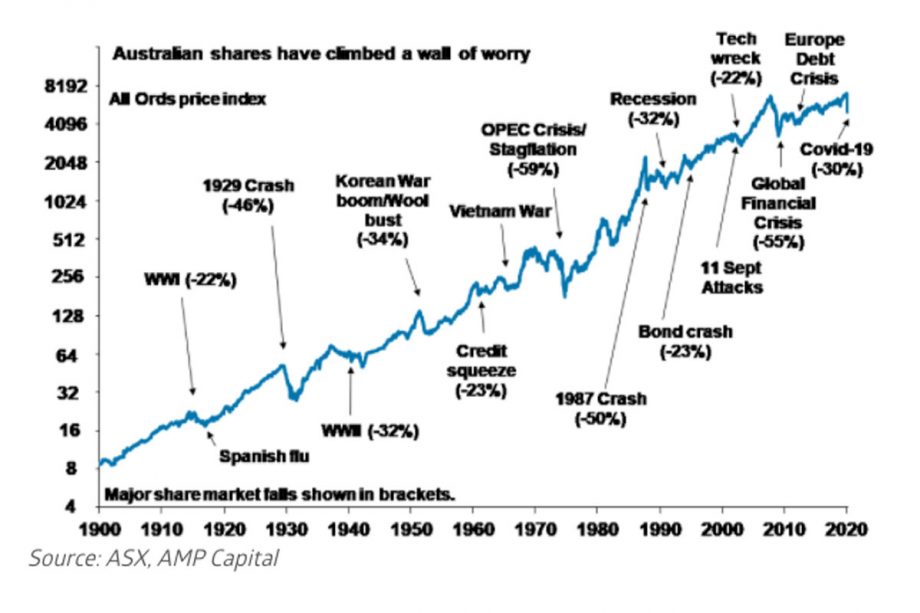

Crucial to this, of course, is that you have a diverse portfolio, or have put your money into a reliable ETF, which tracks the market. It’s also crucial – as mentioned – that the market actually goes up. Though there is solid evidence throughout history that this has always (eventually) happened, you shouldn’t do this with money that you might need to pull out quickly, as one can never predict when the next crash will be.

This is why people nearing retirement will have their superannuation funds invested in much lower risk stocks than someone in their 20s – someone in their 20s has 40 or more years for the market to recover from a potential fall.

As Josh Gilbert, market analyst at eToro, recently told DMARGE, “The stock market is not a get-rich-quick scheme, so investors should consider adopting a long-term investment mindset.”

“Frequently chopping and changing investments means they won’t have a chance to achieve their potential and cuts profits prematurely. Some Australian investment platforms may also charge extra fees for a high volume of trades every month.”

eToro declined to comment on the likelihood of $10,000 returning 10% per annum over the next two decades, if invested into the ASX. However, according to Motley Fool, “Over the long-term, the ASX share market has returned around 10% per annum over the decades.”

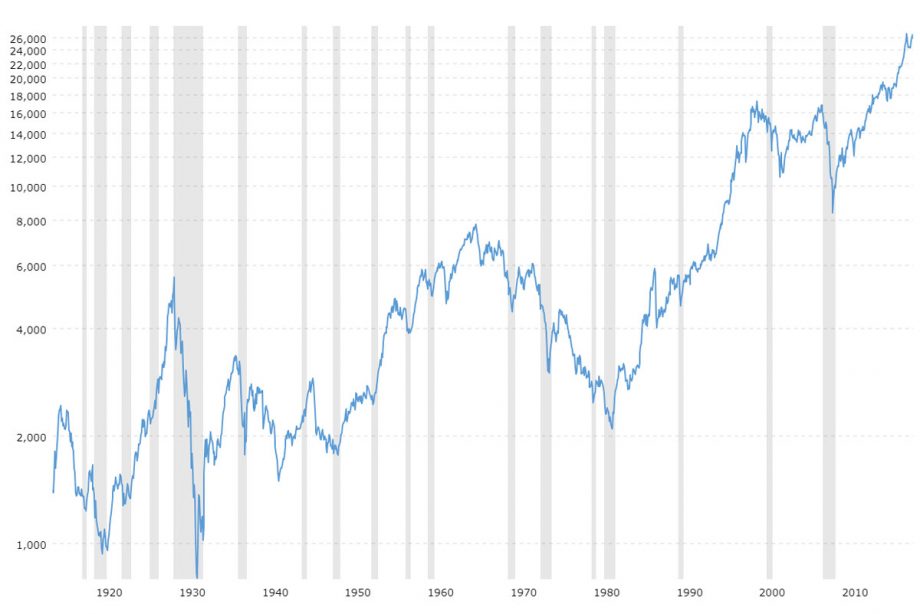

Tight Fist Finance likewise claims: “The benchmark for market returns is the S&P 500. Typically, the S&P 500 has returned an annualized return of 10% since inception.”

“Therefore, the typical average return of an ETF is around 10%, but individual ETF performance varies depending on the index they are tracking.”

America’s S&P 500 has a history of outperforming Australia’s ASX 200. However, some believe this was due to the various tech booms in recent times (with the biggest winners being American companies), and that the next decade could see the ASX perform a little better, relative to the S&P 500. This is pure speculation, however.

To provide a few words of advice (and caution) before you dive on in, DMARGE spoke to Mr Gilbert, to get his thoughts on the questions we should ask ourselves before investing in any company.

Do I understand basic stock market terminology and my chosen investment platform?

Before you start investing, make sure you understand the general lingo and how your preferred investment platform works, Mr Gilbert says.

“You don’t want to accidentally lose money because you misunderstood a term, or clicked the wrong buttons. Some platforms, like eToro, allow you to use a virtual portfolio before you start investing real money, so you can learn the ropes with zero risk.”

“Remember, practice makes perfect.”

What are my investment goals and strategy?

“Not having a financial plan can lead to lack of focus and being easily swayed or impulse investing which often doesn’t end well,” Mr Gilbert said.

“If you don’t have a plan for how to manage your money, you’ll be more vulnerable to impulse buying, overspending and making other unwise decisions. Even if you are earning a lot, failure to plan will likely ruin your set objectives.”

“You should avoid setting goals that are vague, too broad or exaggerated with no timeline,” Mr Gilbert added.

“An example plan could include outlining how much capital you want to invest, the time you want to spend in the market, how many companies or assets you want to invest in, and ways you might hedge against risk- such as diversifying your portfolio or setting stop limits.”

Do I really understand what this company does?

Mr Gilbert told DMARGE: “Ensure you have a basic understanding of what the company does before taking the financial plunge and investing in the stock” and “invest in what you know.”

“By investing in your passions and interests, you are more likely to understand how they best operate.”

“For example, if you love tech, you may decide you want to buy stocks in Apple or Microsoft. Or, if fashion is more your thing, you might want to consider ASOS or H&M. But of course, do your homework on them first, instead of going in blind.”

Am I being led by FOMO?

“Are you just simply investing in a stock because everyone else is? Or because the headlines and ‘finfluencers’ have hyped it up as a ‘must have’ for your portfolio?” Mr Gilbert asks.

“Instead of investing in a stock because of FOMO (fear of missing out), ensure you’re investing for the right reasons and do your research. Do you actually see potential in this stock? If the answer is no, it’s best to back away.”

Am I investing more than I can afford?

This is a big one. As Mr Gilbert told us, “It’s important to understand your risk appetite and how much you can realistically afford to invest, and worst case, lose.”

“It’s a common misconception that you need a lot of money to make investing worthwhile. Thanks to the proliferation of everyday-people-friendly tech platforms, you can invest with as little as USD $50.”

“If you start low but invest regularly, you’ll be surprised how quickly your portfolio will build up.”

“Be mindful of your limits and think about whether you could realistically afford to lose the amount you initially invested in a worst-case-scenario,” he added.

“High-risk mindsets amongst inexperienced investors may result in losses, especially during the global pandemic when markets have been extremely volatile.”

What value will this stock add to my portfolio?

“The truth is, you don’t need to invest in stocks because they’ve just listed and are ‘hot,’ Mr Gilbert told DMARGE. “All stocks should meet a need in your portfolio and it should essentially add an exposure that you already don’t have.”

“Try to diversify your portfolio with a range of different stocks from different industries, as well as commodities and cryptoassets to ensure your portfolio is balanced.”

Do I really understand the risks associated with investing in stocks?

Finally, Mr Gilbert left us with one final warning.

“You should understand that regardless of market conditions, investing in the stock market can be risky.”

“This is why it’s crucial that you’re able to comprehend what you’re investing and don’t invest more than you can afford to lose.”